According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

Tag: Forbearance

Technology Talk: Q&A with SS&C’s Bob Wright, CMB, CCMS

MBA NewsLink interviewed Bob Wright, CMB, CCMS,about SS&C Technologies’ work-from-home experience and his experience with Coronavirus.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

Technology Talk: Q&A with SS&C’s Bob Wright, CMB, CCMS

MBA NewsLink interviewed Bob Wright, CMB, CCMS,about SS&C Technologies’ work-from-home experience and his experience with Coronavirus.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency on Monday announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

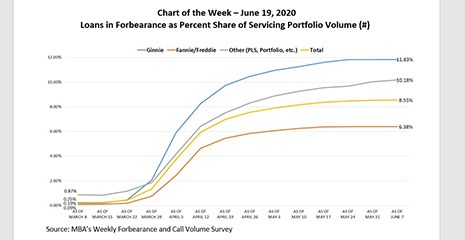

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

Zillow: Newly Unemployed Service Workers Owe $1.7 Billion/Month in Housing Payments

Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

MBA Advocacy Update: June 8, 2020

MBA remains actively engaged with decision-makers at all levels of government to help shape the response to the effects of the pandemic on the mortgage market. Last week, the Senate passed legislation that would ease restrictions on the SBA’s Paycheck Protection Program, which President Trump signed into law on Friday.

FHA, CFPB Issue New Guidance on Forbearance

The Federal Housing Administration and the Consumer Financial Protection Bureau yesterday each announced new policies to assist mortgage borrowers impacted by the economic effects of the coronavirus pandemic.