U.S. title insurance companies’ statutory capital should remain very strong even as macroeconomic pressures mount in the coming months, Fitch Ratings said in a new report.

Tag: Fitch Ratings

Fitch: FHFA Final Capital Rules Supportive of Credit for Fannie, Freddie

Fitch Ratings, New York, said the Federal Housing Finance Agency recent adoption of final regulations requiring the submission of annual capital plans and new public risk disclosures for Fannie Mae and Freddie Mac are creditor positive.

Fitch: FHFA Final Capital Rules Supportive of Credit for Fannie, Freddie

Fitch Ratings, New York, said the Federal Housing Finance Agency recent adoption of final regulations requiring the submission of annual capital plans and new public risk disclosures for Fannie Mae and Freddie Mac are creditor positive.

Fitch: Retail Resolutions Drive May U.S. CMBS Loan Delinquency Rate Lower

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

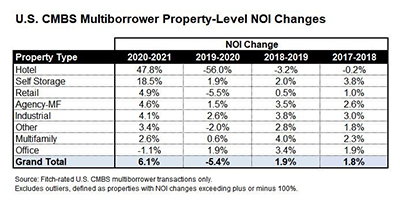

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

Fitch: Weaker Borrowers in U.S. Securitizations Vulnerable to Inflation

Fitch Ratings, New York, said inflation and rising rates will pressure consumers, with the greatest burden on households with low incomes and savings and who have not fully recovered from pandemic-related financial stresses.

Housing Market Roundup Apr. 21, 2022

Here is a summary of housing/economic stories that recently came across the MBA NewsLink desk:

CMBS Delinquency Rate Maintains Downward Trajectory

The commercial mortgage-backed securities delinquency rate fell 10 basis points during March to 2.38 percent, driven by robust new issuance and few new delinquencies, reported Fitch Ratings, New York.

Housing Market Roundup: Apr. 8, 2022

Here’s a quick-hit summary of recent housing reports that came across the MBA NewsLink desk: