HUD announced $28,625,000 available to fair housing organizations across the nation working to fight housing discrimination. The funds will support a variety of activities, including fair housing education and outreach, testing and enforcement, through the Department’s Fair Housing Initiatives Program.

Tag: Fitch Ratings

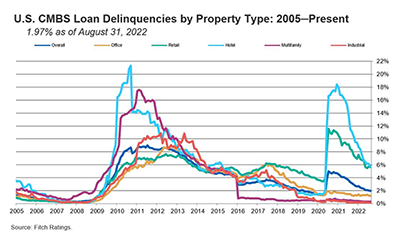

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.

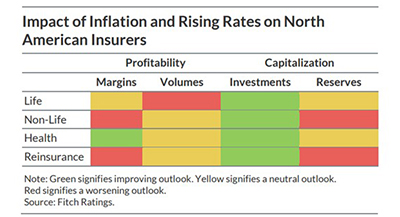

Fitch: Rising Rates, Inflation Weigh on Insurance Sector

Fitch Ratings, Chicago, said inflationary pressures and a potential modest recession could pave the way for a revision of sector outlooks to “Deteriorating” for North American insurers before the year is out.

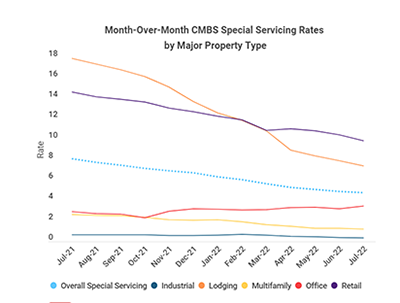

CMBS Special Servicing, Delinquency Rates Dip

Commercial mortgage-backed securities special servicing and delinquency rates both dipped in July, according to Trepp LLC and Fitch Ratings.

Housing Market Roundup Aug. 22 2022

Here’s a quick summary of housing/real estate finance articles that have come across the MBA NewsLink desk:

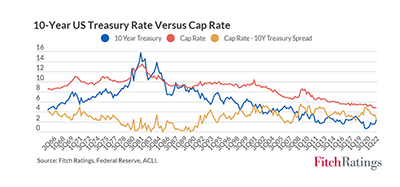

Fitch: Stagflation Threatens Commercial Real Estate Values

Stagflation could lead to lower U.S. commercial real estate valuations, said Fitch Ratings, New York.

Industry Briefs Aug. 10, 2022: TransUnion Says Serious Delinquencies ‘Normalizing’ to Pre-Pandemic Levels

TransUnion, Chicago, said the first half of 2022 concluded with a normalization in serious delinquency rates to pre-pandemic levels for most credit products as lenders continued to expand access to credit cards and personal loans.

Industry Briefs Aug. 5, 2022: Fannie Mae Survey Cites Cost-Cutting as Top 2022 Business Priority

Fannie Mae, Washington, D.C., said mortgage lenders appear to be adapting their business priorities to meet what they believe are a new set of challenges, including weakened mortgage demand and rising rates.

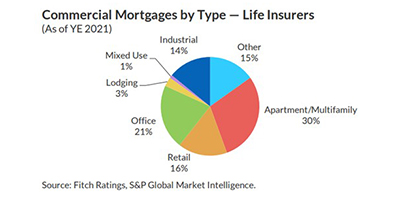

Fitch Ratings: U.S. Life Insurers’ Commercial Mortgages Stable Amid Growing Headwinds

Fitch Ratings, New York, said U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors.

Fitch Ratings: Title Insurers Brace for Macroeconomic Pressures

U.S. title insurance companies’ statutory capital should remain very strong even as macroeconomic pressures mount in the coming months, Fitch Ratings said in a new report.