Stores with multiple ways to engage with customers have a solid, defensible position in the retail landscape given consumer preference for some level of in-person shopping, reported Fitch Ratings, New York.

Tag: Fitch Ratings

Fitch: U.S. Homeowners Insurers to See Improved 2023 Results on Premium Growth

Fitch Ratings, Chicago, said U.S. homeowners’ insurance is poised to post a statutory underwriting loss for 2022 reported results, as insurers continue to face above-average catastrophe losses and claims cost uncertainty from persistently high inflation and heightened macroeconomic volatility.

Industry Briefs Mar. 17, 2023: HUD Overhauls Disaster Recovery Program

HUD announced an overhaul of the agency’s disaster recovery efforts to better serve communities that face the direct impacts of weather-related disasters.

February Housing Starts Up Nearly 10%

February housing starts, permits and completions posted near double-digit percentage increases, ending five months of declines, HUD and the Census Bureau reported Thursday.

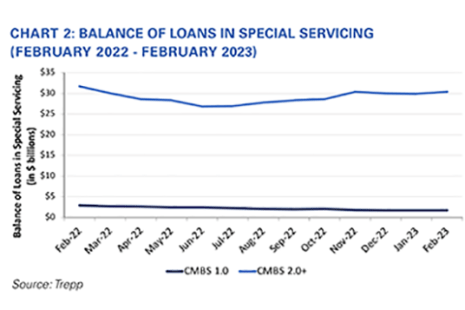

CMBS Delinquency Rate Dips; Special Servicing Rate Increases

Fitch Ratings, New York, reported the commercial mortgage-backed securities delinquency rate decreased two basis points in February to 1.83%.

Industry Briefs Mar. 3, 2023: Fitch Ratings Says FHA Premium Cuts ‘Credit Neutral’ for Private Mortgage Insurers

Fitch Ratings, New York, said recently announced reductions in the Federal Housing Authority mortgage insurance premium rates are not expected to have a meaningful credit impact on private U.S. mortgage insurance carriers.

Fitch: RMBS Servicers Focus on Post-Pandemic Performance

Fitch Ratings, New York, said mortgage servicers are anticipating increased regulatory scrutiny in 2023 as borrowers continue to exit forbearance assistance plans and seek help with their mortgage payments.

Industry Briefs Jan. 31, 2023: Revolution Mortgage Partners with Silverwork Solutions

Silverwork Solutions, Chicago, a developer of digital workforce BOTs, announced a partnership with Revolution Mortgage, Columbus, Ohio.

Housing Market Roundup Jan. 10, 2023

Here’s a summary of recent housing/economics articles that came across the MBA NewsLink desk:

Fitch: Potential Recession, Scarce Capital to Slow REITs Pandemic Recovery

Fitch Ratings, New York, said challenging economic and financial trends for U.S. real estate investment trusts will continue into 2023 after emerging in 2022.