Here’s a quick-hit summary of several housing and housing finance reports released over the past several days:

Tag: Fitch Ratings

CMBS Delinquency Rate Declines for Third Straight Month

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 14 basis points in January to 4.55 percent due to a slowing pace of new delinquencies and strong new issuance.

Industry Briefs Feb. 3, 2021

Rocket Mortgage, Detroit, launched a national mortgage broker directory, which is prominently displayed on its website.

Industry Briefs Jan. 15, 2021

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will extend several loan origination flexibilities until February 28. The changes are to ensure continued support for borrowers during the COVID-19 national emergency. The flexibilities were set to expire on January 31.

Low Rates Driving CMBS Defeasance Trend

Fitch Ratings, New York, said commercial mortgage-backed securities borrowers are taking advantage of the current low interest rate environment to defease their loans.

Housing Market Roundup

So much news, so little time and space. The end of the year seems to bring out the volume in housing market reports, so here are a couple paragraphs each on some of the latest reports to come across our desks:

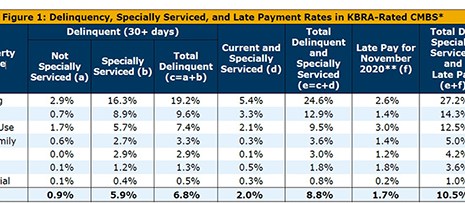

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.

REIT Outlook Negative, But Improving

The 2021 rating outlook for U.S. real estate investment trusts remains negative, but Fitch Ratings, New York, said its outlook for the sector is improving.

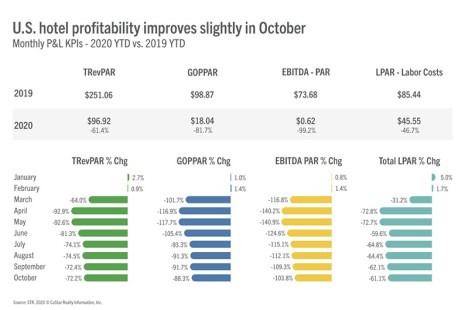

Hotel Sector Recovery Slows

The hotel sector recovery has slowed in recent months after rebounding in the fall from April lows, said Fitch Ratings, New York.

Industry Briefs Dec. 3, 2020

ReverseVision, San Diego, updated all documents that reference an index to support both the Constant Maturity Treasury (CMT) and London Interbank Offer Rate (LIBOR) indexes.