This morning’s Monday Report features stories that confirm the housing markets remain hot, regardless of location or political preference; what that might mean for down payments; and a housing survey that, thanks to the coronavirus pandemic, was obsolete the moment it was released.

Tag: First American Financial Corp.

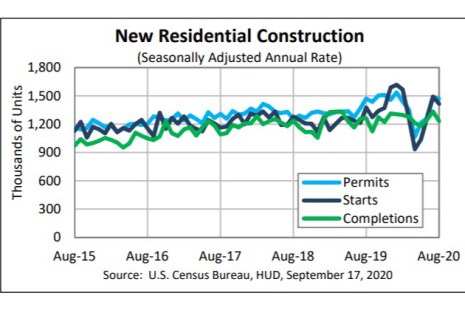

After Strong Summer, August Housing Starts Underwhelm

Housing starts—one of the bright spots in a red-hot summer housing market—faltered in August, HUD and the Census Bureau reported yesterday, although most of the decline took place in multifamily.

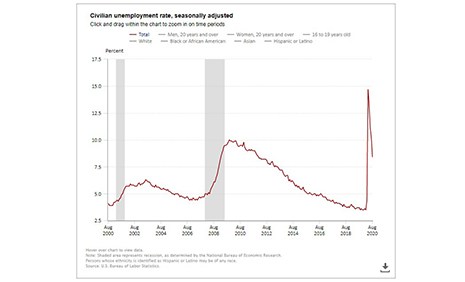

Employment Report: Progress, ‘But a Long Way to Go’

Total nonfarm payroll employment rose by 1.4 million in August, while the unemployment rate fell to 8.4 percent, the U.S. Bureau of Labor Statistics reported Friday.

Signs Point Toward Continued House Price Appreciation

Ahead of this morning’s S&P CoreLogic Case-Shiller Home Price Indexes, a report from First American Financial Corp., Santa Ana, Calif., said low mortgage rates, tight supply and demographic demand will continue to drive home price appreciation well into autumn.

Lack of Supply Hinders Housing Market’s Full Potential

Despite the housing market’s show of strength this summer amid economic turmoil sparked by the coronavirus pandemic, it has yet to reach its full potential because of ongoing supply restraints, said First American Financial Corp., Santa Ana, Calif.

With Wind at Its Back, Housing Starts Continue Summer Surge

Housing starts posted double-digit increases for the second straight month, HUD and the Census Bureau reported yesterday, to its highest level since February.

First American: House Price Appreciation Likely to Accelerate Through Summer

First American Financial Corp., Santa Ana, Calif., said its Real House Price Index shows the supply and demand imbalance that existed entering the coronavirus pandemic has persisted, and even worsened, meaning house price growth will likely remain strong this summer.

Housing Starts Post Healthy June Gain

July has been a good month for the housing industry thus far; HUD and the Census Bureau kept the momentum going Friday with a positive report on housing starts.

Housing Finance Roundup: Purchase Market Strength; Millennial Buying Power; COVID-19 Effect on Homeownership Plans; Bidding Wars Intensify; Home Price Growth Persists

Here is the latest Housing Finance Roundup, with summaries of reports from Ellie Mae; First American Financial Corp.; Bankrate.com; Zillow; and Redfin.

Housing Finance Roundup: July 13, 2020

MBA NewsLink summarizes more than half a dozen new reports from Redfin; Zillow; First American Financial Corp.; Fitch Ratings; ATTOM Data Solutions; and Black Knight.