Employment Report: Progress, ‘But a Long Way to Go’

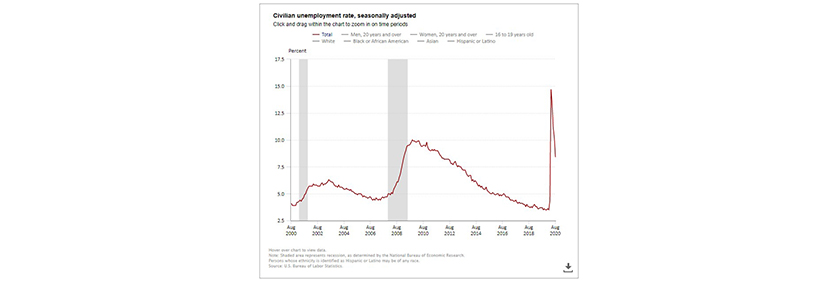

Total nonfarm payroll employment rose by 1.4 million in August, while the unemployment rate fell to 8.4 percent, the U.S. Bureau of Labor Statistics reported Friday.

BLS noted the increase stemmed largely from temporary hiring for the 2020 Census. Notable job gains also occurred in retail trade, in professional and business services, in leisure and hospitality and in education and health services.

The report said the number of unemployed persons fell by 2.8 million to 13.6 million. Both measures have declined for four consecutive months but are higher than in February, by 4.9 percentage points and 7.8 million, respectively. The unemployment rate fell to under double digits for the first time since April.

BLS revised down June unemployment by 10,000, from 4,791,000 to 4,781,000; July was revised down by 29,000, from +1,763,000 to +1,734,000. With these revisions, employment in June and July combined was 39,000 less than previously reported.

“The 1.4 million increase in employment in August, while strong by historical standards, still shows the economy has a long way to go,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Payrolls are still 7.6 percent below where they were before the crisis. It is also notable that about a fourth of the increase was due to gains in government employment.”

Fratantoni said the sharp drop in the unemployment rate “was certainly a surprise,” calling 3.1 million workers reported being called back from temporary furlough “a significant improvement ,” but another 500,000 individuals now report being on a permanent layoff. “The decline in the unemployment rate was driven by a drop in those who had been out of job for five weeks or less, indicating that there is still a high degree of churn in this job market,” he said. “That said, both the headline unemployment rate and the broader measures of underemployment move down in line, indicating that more people have been able to find steadier work.”

Fratantoni noted the Federal Reserve last week rolled out a new monetary policy framework that is much more focused on the job market, with a commitment to keep rates low until inflation visibly increases, rather than moving in anticipation of a rise due to a tighter job market. “We are still likely years away from a change in monetary policy,” he said. “However, this sudden drop in the unemployment rate does suggest that the economy could be healing more quickly than anticipated.”

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the economy continues to show signs of fatigue.

“Less than half the jobs lost have been recovered,” House said. “The jobs market continues to slowly heal, with employers adding 1.37 million jobs in August. That marked a slowdown from prior months, however, and is another indication that the recovery is losing momentum after the initial burst of activity from re-opening.”

House noted in “ordinary” times, a 1.37 million gain in payrolls would be considered substantial. “But of course these are no ordinary times,” she said. “Payrolls remain 11.5 million below their February level, with still under half of the jobs lost recovered. An increasing share of the jobs lost since the start of the pandemic have become permanent…as we head into a weekend that celebrates the American worker, the smallest share of the population is working since the mid-1970s.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the rise in permanent job losses signal .

“The fate of the labor market will determine the pace of economic recovery,” Kushi said. “One thing this month’s job report made clear is that permanent economic damage continued to increase, as the number of permanent job losses increased from 1.5 million in March to 3.4 million in August. Companies are starting to make more permanent staffing changes as the pandemic lingers. The increase in permanent job losses points to longer-term unemployment and prolonged economic recovery.”

Kushi also noted housing has remained immune due to demographic demand and the Fed policy keeping rates low, “but it cannot remain immune to the impact of homeowners having less household income.”

“On the face of it, household survey results appear much more optimistic than payroll survey results; however, the household survey tends to be more volatile, given its significantly smaller sample size,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “This may be especially true lately; the BLS noted the household survey response rate in August was well below its recent average, which may yield additional volatility.”

The report said the labor force participation rate increased by 0.3 percentage point to 61.7 percent in August but is 1.7 percentage points below its February level. Total employment, as measured by the household survey, rose by 3.8 million in August to 147.3 million. The employment-population ratio rose by 1.4 percentage points to 56.5 percent but is 4.6 percentage points lower than in February.

BLS said the number of persons who usually work full time rose by 2.8 million to 122.4 million in August, and the number who usually work part time increased by 991,000 to 25.0 million. Part-time workers accounted for about one-fourth of the over-the-month employment gain.

The report also said 24.3 percent of employed persons teleworked because of the coronavirus pandemic, down from 26.4 percent in July.

Average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $29.47. Average hourly earnings of private-sector production and nonsupervisory employees increased by 18 cents to $24.81, following a decrease of 10 cents in the prior month. BLS said large employment fluctuations over the past several months–especially in industries with lower-paid workers–complicate the analysis of recent trends in average hourly earnings.

The average workweek for all employees on private nonfarm payrolls increased by 0.1 hour to 34.6 hours in August. In manufacturing, the workweek rose by 0.3 hour to 40.0 hours, and overtime increased by 0.1 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 34.0 hours.