Built efficiently in off-site facilities and regulated by federal construction standards that supersede state and local codes, modern manufactured homes are cost-effective, energy efficient and quicker to build than traditional site-built housing.

Tag: FHFA

MBA Letter to Senate Banking Committee on Bill Pulte’s Nomination to Lead FHFA

MBA released a letter to express the real estate finance industry’s strong support for President Trump’s nomination of William J. “Bill” Pulte to be the next Director of the Federal Housing Finance Agency.

Chart of the Week: FHFA Purchase-Only House Price Index

Annualized home price growth in the U.S. peaked between the second half of 2021 and first half of 2022 before decelerating through most of 2023 as rising mortgage rates and tight inventory contributed to a pullback in demand.

MBA Statement on FHFA and Treasury Amendments to the Preferred Stock Purchase Agreements

MBA President and CEO Bob Broeksmit, CMB, issued a statement on Federal Housing Finance Agency and U.S. Treasury amendments to the Preferred Stock Purchase Agreements.

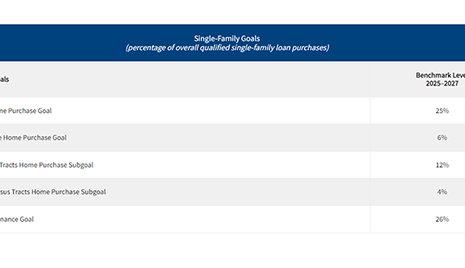

FHFA Finalizes 2025–2027 Housing Goals for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency issued a final rule Thursday establishing new affordable housing goals for the loan purchases of Fannie Mae and Freddie Mac over the next three years.

MBA Statement on FHFA’s 2025 Multifamily Loan Purchase Caps

MBA’s President and CEO Bob Broeksmit, CMB, released a statement regarding the Federal Housing Finance Agency’s (FHFA) announcement of the 2025 multifamily lending purchase caps for Fannie Mae and Freddie Mac (the GSEs).

People in the News, Nov. 19, 2024

Industry personnel news from Dark Matter Technologies, Optimal Blue, MAXEX, MBA, Fannie Mae, FHFA, Certainty Home Lending and Provident Bank.

FHFA Announces Updates on Repurchases, Appraisals, Pricing at Annual24

DENVER–The Federal Housing Finance Agency’s Naa Awaa Tagoe, Deputy Director, Division of Housing Mission and Goals, announced a series of updates at the Mortgage Bankers Association Annual Conference & Expo Oct. 28.

MBA Statement on FHFA Updates on Loan Repurchases, Appraisals, and Pricing

DENVER–MBA President and CEO Bob Broeksmit, CMB, issued the following statement on today’s Federal Housing Finance Agency (FHFA) announcements on loan repurchases, appraisals, and pricing at MBA’s 2024 Annual Convention and Expo.

Industry Briefs, Oct. 11, 2024

Industry briefs from the Federal Housing Finance Agency, Snapdocs, Zions Bancorporation and Informative Research.