If home price appreciation is supposed to ease up this year, it’s showing no such signs so far.

Tag: FHFA House Price Index

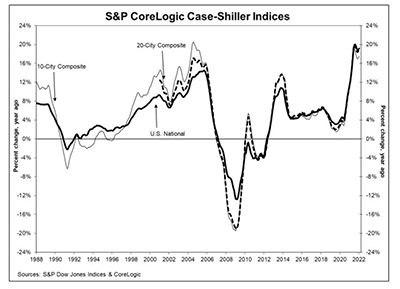

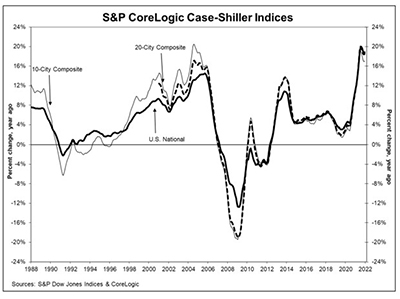

Home Prices Finish Year at Highest Rate of Increase in 34 Years

The S&P CoreLogic Case-Shiller Home Price Indexes finished 2021 with the single-highest rate of increase in 34 years of data-keeping. In a separate report, the Federal Housing Finance Agency said 2021 home prices rose by 17.5 percent.

Industry Briefs Aug. 6, 2021

CoreLogic, Irvine, Calif., said its analysis of homebuyer migration trends in 2020 found coastal metro areas in Florida such as Lakeland and Tampa ranking highest, as many moved away from large coastal areas such as New York, Los Angeles and San Francisco.

Industry Briefs Aug. 5, 2021

CoreLogic, Irvine, Calif., said its analysis of homebuyer migration trends in 2020 found coastal metro areas in Florida such as Lakeland and Tampa ranking highest, as many moved away from large coastal areas such as New York, Los Angeles and San Francisco.

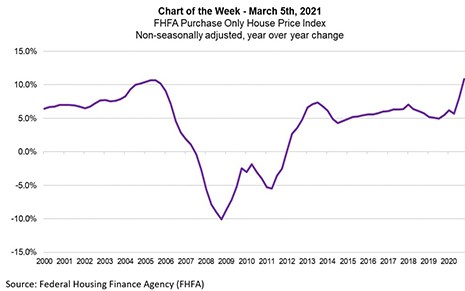

MBA Chart of the Week Mar. 5 2021: FHFA Purchase-Only Index

The rate of U.S. home-price appreciation continues to be driven higher by a combination of strong demand for housing and record-low housing inventory for sale. The Federal Housing Finance Agency’s most recent release showed the fourth quarter saw annual home-price growth of 10.9 percent –the strongest annual change on record. The previous high was an increase of 10.7 percent in third quarter 2005.

Absent Inventories, Home Prices Continue to Soar

November saw no letup in the S&P CoreLogic Case-Shiller Home Price Indices, with home prices nationwide jumping by 7 percent annually. And the Federal Housing Finance Agency said it was even more, rising by nearly 8 percent.

FHFA: 2021 GSE Conforming Loan Limits Increase to $548,250

The Federal Housing Finance Agency yesterday announced a nearly $40,000 jump in maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021.