NorthMarq’s Chicago office arranged $103.5 million to refinance six multifamily assets in Iowa, Missouri and Indiana.

Tag: FHA

FHA Follows Suit, Raises Single-Family Loan Limits for 2021

As expected, the Federal Housing Administration yesterday matched Fannie Mae and Freddie Mac in its single-family and Home Equity Conversion Mortgage insurance programs for 2021.

Industry Briefs Oct. 23, 2020

Black Knight Inc., Jacksonville, Fla., launched a Customer Service platform that provides an enhanced customer service experience for both customer service representatives and consumers.

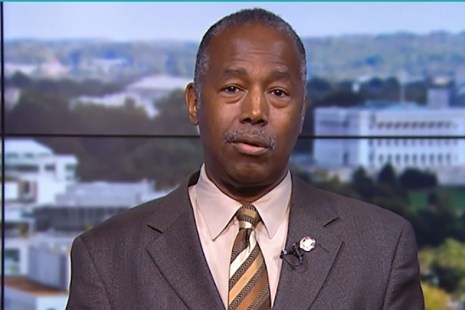

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson yesterday announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

Dealmaker: Red Mortgage Capital Provides $39M FHA Loan

Red Mortgage Capital, Columbus, Ohio, provided a $39.3 million Federal Housing Administration refinance for Liberty BLVD, a 266-unit apartment community in Salt Lake City, Utah.

MBA Advocacy Update Sept. 14, 2020

With Congress (most notably the Senate) unable to reach consensus on the passage of any additional COVID-related economic relief, MBA sent a letter last Tuesday to the CFPB responding to the Bureau’s proposed rule revising the General QM definition. The letter explains MBA’s support for the price-based QM construct, and offers several recommendations to help ensure the rule meets its stated goals of robust consumer protections and broad access to sustainable credit.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD yesterday announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

Industry Briefs Aug. 20, 2020

Freedom Mortgage Corp., Mount Laurel, N.J., and RoundPoint Mortgage Servicing Corp., Charlotte, N.C. completed their previously announced merger. RoundPoint is now a wholly owned subsidiary of Freedom Mortgage, a full-service mortgage company and provider of VA and government-insured lending.

Industry Briefs Aug. 19, 2020

Freedom Mortgage Corp., Mount Laurel, N.J., and RoundPoint Mortgage Servicing Corp., Charlotte, N.C. completed their previously announced merger. RoundPoint is now a wholly owned subsidiary of Freedom Mortgage, a full-service mortgage company and provider of VA and government-insured lending.

Dealmaker: Bellwether Enterprise Closes $21M Affordable Housing Deal

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed a $20.5 million loan to rehabilitate and preserve affordability of nine multifamily properties in West Town and Humboldt Park in Chicago.