The Consumer Financial Protection Bureau took action against Nationwide Equities Corp. for sending deceptive loan advertisements to hundreds of thousands of older borrowers.

Tag: FHA

Industry Briefs Feb. 25, 2021

Finicity, Salt Lake City, announced its one-touch Mortgage Verification Service, enabling lenders to allow consumers to permission data so lenders can verify assets, income and employment in a single interaction. The verification is accepted by both Freddie Mac and Fannie Mae.

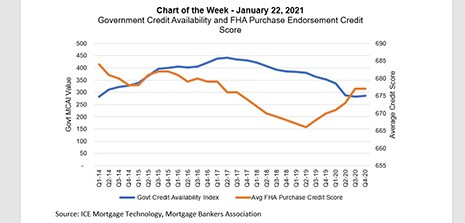

MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

HUD Extends FHA Foreclosure/Eviction Moratorium through Mar. 31

HUD yesterday extended the moratorium on FHA single-family foreclosures and evictions through Mar. 31.

FHA to Permit DACA-Status Recipients to Apply for FHA-Insured Mortgages

HUD said this morning it will permit individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service and are legally permitted to work in the U.S. to apply for mortgages backed by FHA.

FHA to Permit DACA-Status Recipients to Apply for FHA-Insured Mortgages

HUD said yesterday it will permit individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service and are legally permitted to work in the U.S. to apply for mortgages backed by FHA.

Housing Market Roundup, Jan. 4, 2021

We hope you had an enjoyable holiday break. Here is a summary of some reports that came out over the holidays:

Industry Briefs Dec. 23, 2020

The Federal Housing Administration announced completion of its revised and streamlined loan-level certification form required from lenders when originating a single-family mortgage intended for FHA insurance endorsement.

Industry Briefs Dec. 21, 2020

New American Funding, Tustin, Calif., launched a mentorship program to help team members develop professionally. New American Funding’s “360 Mentorship Program” matches an internal leader with another employee who is pursuing career advancement.

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.