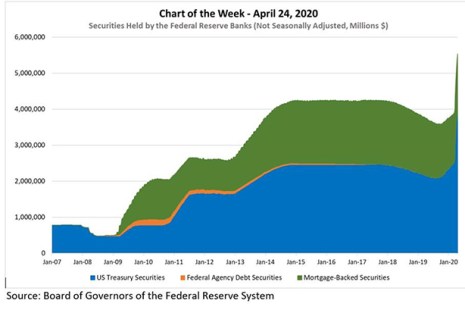

The MBA Chart of the Week shows the evolution of securities held outright by the Federal Reserve Banks since 2007.

Tag: Federal Reserve

Mortgage Action Alliance ‘Call to Action’ Urges Congress to Act on Liquidity Facility

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a ‘Call to Action’ on Friday, urging its members to contact their members of Congress to support legislation that would provide lenders and servicers with liquidity support.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve yesterday announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve this morning announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

MBA, Trade Groups Release Statement Urging Regulators to Establish Liquidity Facility

The Mortgage Bankers Association and a broad coalition of organizations representing financial industry and affordable housing advocates on Saturday released a statement calling on government regulators to provide a source of liquidity to those mortgage servicers that may need additional capacity to support homeowners and renters impacted by COVID-19.

CRE Finance in an Uncertain World

MBA hosted a webinar on Friday, March 27 with commercial real estate finance industry leaders to discuss COVID-19’s impacts on the industry.

Federal Agencies Issue Final Rule to Mitigate CECL Effects

Three federal agencies on Friday announced actions to allow banking organizations to continue lending to households and businesses: providing an optional extension of the regulatory capital transition for the new credit loss accounting standard; and allowing early adoption of a new methodology on how certain banking organizations are required to measure counterparty credit risk derivatives contracts.

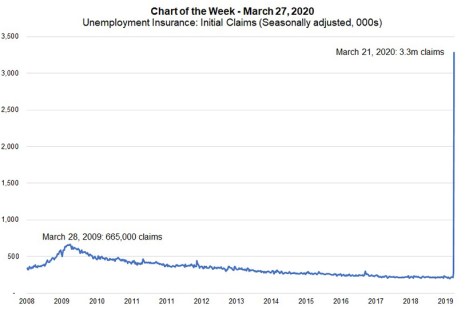

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.