MBA Chart of the Week: Goods and Services Inflation

(Source: Bureau of Labor Statistics)

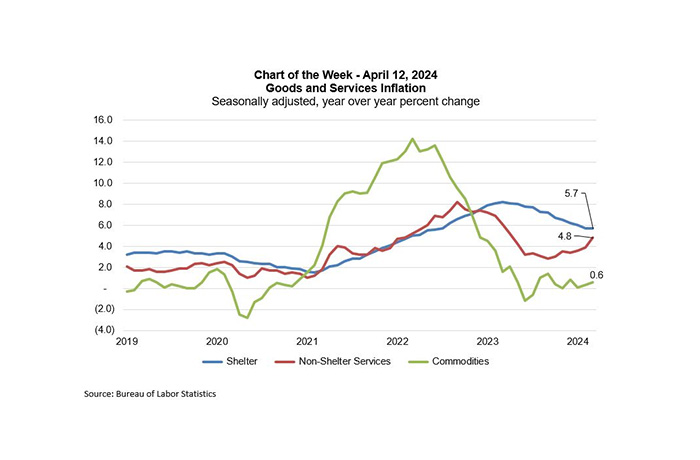

The week’s news has been around the Consumer Price Index (CPI) release showing that inflation was hotter than expected in March, which is likely to delay the Federal Reserve’s first rate cut in 2024 and contributed to a significant spike in the 10-year Treasury yield to over 4.5%. Rates were already moving higher the week before following a strong jobs report and Fed officials signaling the possibility of later and fewer rates cuts in 2024. The headline CPI showed an annual growth rate of 3.5%, an acceleration from last month’s reading of 3.2% and the strongest annual gain since September 2023. Most of the March increase was driven by price increases in service providing industries.

Our Chart of the Week shows the three broad categories of inflation within the CPI series, but our focus for now is non-shelter services, which is closely tied to the job market as covered in last week’s chart, and broader strength in the economy that is supporting the demand for services. The shelter component accounts for more than a third of the CPI and we plan to address that separately in the weeks ahead.

Non-shelter service prices grew 4.8% compared to a year ago, the strongest month since April 2023, driven by categories such as medical care services and transportation services, specifically motor vehicle repair and motor vehicle insurance. Job openings are still elevated and this is supporting wage growth of over 4%. Businesses have been able to pass some of these costs on to consumers, which is keeping prices higher in many service industries.

Fed officials point to various data showing that the labor market is still tight, and inflation is holding well above their 2% target, and have hinted that rates might need to be higher for longer to cool things down. The FOMC will likely need to see at least a few months of improving inflation before cutting rates. We now expect that there will be two rate cuts in 2024 with the first in the third quarter. With respect to longer-term rates, this means a slower downward trend for the 10-year, likely staying above 4% through the end of 2024. Look for more details in the April version of our forecast which will be out this week.

Mike Fratantoni (mfratantoni@mba.org), Joel Kan (jkan@mba.org)