November CPI Posts Welcome ‘Modest’ Increase

It’s not often that “modest” has economic significance, but when it refers to inflation as of late, then “modest” is perhaps a welcome description.

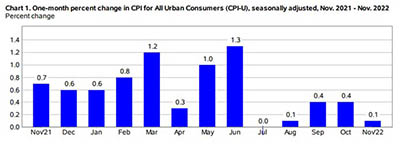

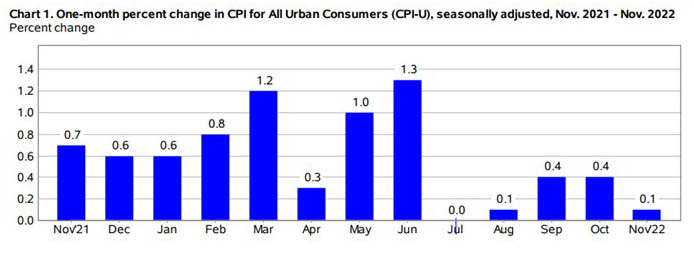

On Tuesday, the Bureau of Labor Statistics reported its monthly Consumer Price Index rose by just 0.1 percent in November—the smallest increase since last December. On an annual basis, the CPI rose by 7.1 percent, slightly higher than in October but still well down from its recent breakneck pace.

“Inflation is more firmly on a downward trend,” said Sara House, Senior Economist with Wells Fargo Economics, Charlotte, N.C.

The report said the index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased by 0.5 percent over the month, with the food at home index also rising by 0.5 percent. The energy index decreased by 1.6 percent over the month as the gasoline index, the natural gas index and the electricity index all declined.

The index for all items less food and energy rose by 0.2 percent in November, after rising by 0.3 percent in October. The indexes for shelter, communication, recreation, motor vehicle insurance, education and apparel were among those that increased over the month. Indexes which declined in November include the used cars and trucks, medical care, and airline fares indexes.

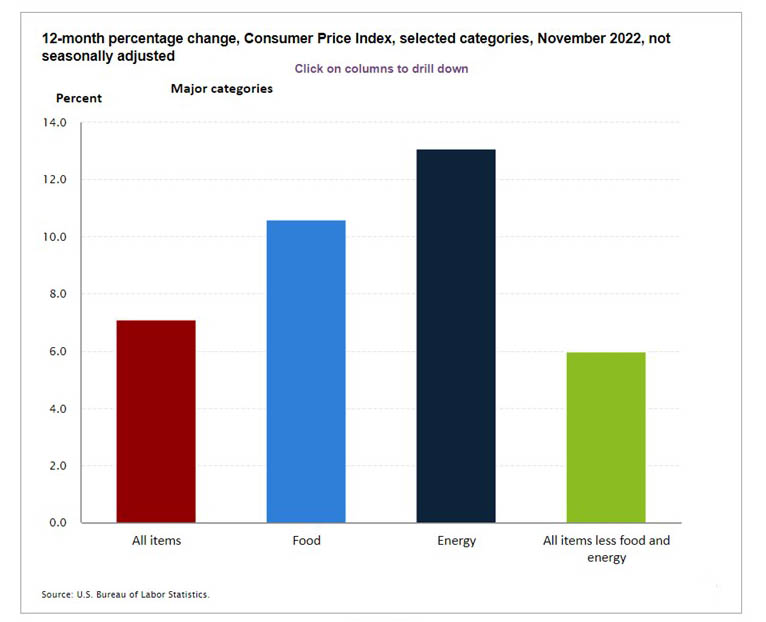

The all-items index increased by 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all-items less food and energy index rose by 6.0 percent over the past 12 months. The energy index increased by 13.1 percent for the 12 months ending November, and the food index increased by 10.6 percent over the past year; all of these increases were smaller than for the period ending October.

House said the lower-than-expected November data could have some influence on the Federal Reserve, whose December Federal Open Market Committee policy meeting began Tuesday and concludes this afternoon.

“A reversal in energy prices and core goods—particularly vehicle prices—are going a long way toward reducing inflation,” House said. “Services prices are proving slower to retreat, but here too, there were signs of stretched consumers and fading demand beginning to tamp down pricing power with travel-related services falling across the board.”

House said while the pace of inflation is expected to slow further over the next few months, “the roughly 5% pace of wage growth is likely to keep the Fed in inflation-fighting mode for a while yet. We look for the Fed to proceed with its signaled 50 bps hike [Wednesday], although the prospect of a further downshift to a 25 bps hike come its first meeting of 2023 has increased with this report.”

The FOMC statement comes out at 2:00 p.m. ET this afternoon. Mike Fratantoni, Chief Economist with the Mortgage Bankers Association, will provide commentary and analysis on the FOMC statement in Thursday’s MBA NewsLink.