Each quarter, the Federal Open Market Committee submit their projections for various economic measures. This month’s projections, shown in the Summary of Economic Projections, include 2028 for the first time.

Tag: Federal Open Market Committee

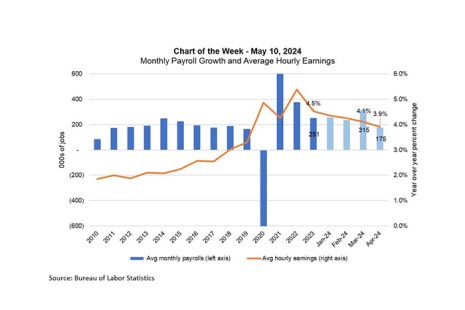

MBA Chart of the Week: Monthly Payroll Growth, Average Hourly Earnings

The Federal Open Market Committee (FOMC) left the federal funds target unchanged at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the expected timing of a first rate cut.

Fed Holds Rates Steady; Signals Cut Later

The Federal Reserve’s Federal Open Market Committee held rates unchanged at its March meeting and continued to signal its next move will be a rate cut.

Fed Holds Rates Steady

The Federal Open Market Committee held rates steady on Wednesday, stating that “the risks to achieving its employment and inflation goals are moving into better balance”

FOMC Holds Rates Steady

The Federal Open Market Committee held interest rates steady yesterday–as many forecasters had predicted.

Fed Raises Key Interest Rate by 25 Basis Points

The Federal Reserve’s Federal Open Market Committee increased short-term rates at its July meeting, responding to high but moderating inflation and a job market that remains quite strong.

Fed Keeps Rates Steady But Options Open

The Federal Open Market Committee held rates steady at its June meeting but kept its options open for July and later this year.

Fed Raises Rates; Is That It?

The Federal Open Market Committee on Wednesday, as expected, raised the federal funds rate by another 25 basis points to its highest level since July 2007. And while it hinted this might be the final increase for a while, it left open the door for more action should economic conditions warrant.

The Week Ahead, May 1, 2023: The Fed, Jobs Reports; and Countdown to MBA Spring Conferences

The Federal Open Market Committee holds its regularly scheduled policy meeting this Tuesday, May 2 and Wednesday, May 3, issuing its policy statement at 2:00 p.m. ET on Wednesday.

Fed Adds 25 Basis Points to Federal Funds Rate

The Federal Open Market on Wednesday raised the federal funds rate by another 25 basis points, a move widely anticipated by analysts and financial markets.