Revvin, Chicago, released a set of HELOC-specific workflows that make it easier for lenders to attract home equity line of credit applicants and gather the required information for delivery to the lender’s LOS.

Tag: Federal Housing Finance Agency

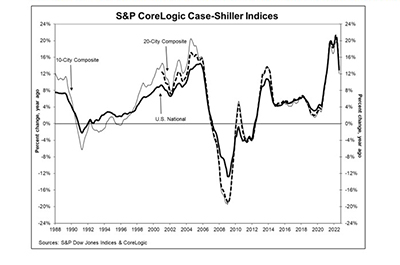

Home Prices Continue ‘Forceful Deceleration’

Tuesday’s reports confirm a steady, even “forceful” deceleration in home prices.

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

MBA Urges FHFA to Embrace Standards-Based Technology Approaches to Fintech

The Mortgage Bankers Association, in a letter last week to the Federal Housing Finance Agency, said the Agency should not inadvertently hinder innovation through choices made by its regulated entities.

MISMO Seeks Public Comment on FIPS Code Lending Limit API Specification

MISMO®, the real estate finance industry standards organization, seeks public comment on a new FIPS Code Lending Limit API Specification, which will illustrate how to define a standard REST-based OpenAPI for searching lending limits based on a property’s postal code and county name.

Industry Briefs Oct. 6, 2022: HUD Allocates $28M to Fight Housing Discrimination

HUD announced $28,625,000 available to fair housing organizations across the nation working to fight housing discrimination. The funds will support a variety of activities, including fair housing education and outreach, testing and enforcement, through the Department’s Fair Housing Initiatives Program.

FHFA: GSEs Complete 97,000 2nd Quarter Foreclosure Preventions

The Federal Housing Finance Agency released its second quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 96,945 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,591,002 since start of conservatorships in September 2008.

FHFA Announces ‘Comprehensive Review’ of FHLB System

The Federal Housing Finance Agency on Wednesday announced it will conduct a comprehensive review of the Federal Home Loan Bank System beginning this fall.

FHFA Announces ‘Comprehensive Review’ of FHLB System

The Federal Housing Finance Agency on Wednesday announced it will conduct a comprehensive review of the Federal Home Loan Bank System beginning this fall.