The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

Tag: Federal Housing Finance Agency

Administration Announces Steps to Increase Affordable Housing Supply

The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

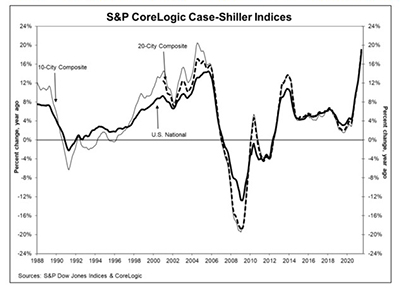

Home Price Reports: Housing Market at Full Speed

If home prices are cooling off, it’s not evident in the numbers: reports from S&P Dow Jones Indices and the Federal Housing Finance Agency show home prices with annual gains of nearly 20 percent.

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals.

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals.

Industry Briefs Aug. 17, 2021

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

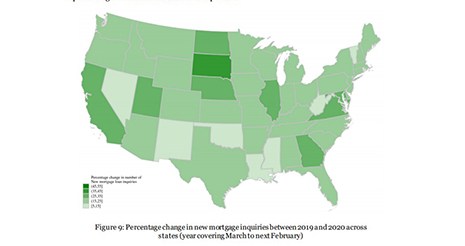

CFPB, FHFA Release Updated Data from National Survey of Mortgage Originations

The Consumer Financial Protection Bureau and the Federal Housing Finance Agency published updated loan-level data for public use collected through the National Survey of Mortgage Originations.

FHFA Encourages Landlords to Apply for Emergency Rental Assistance Before Evicting Tenants

The Centers for Disease Control’s eviction moratorium expired July 31, but the Department of Agriculture, HUD, the Department of Veterans Affairs and the Federal Housing Finance Agency have extended their foreclosure-related eviction moratoria until September 30. The agencies issued a joint statement Friday encouraging landlords of properties backed by Fannie Mae or Freddie Mac to apply for Emergency Rental Assistance before starting the process of evicting a tenant for non-payment of rent.

FHFA, FHA Extend Single-Family Eviction Moratoria through Sept. 30

The Federal Housing Finance Agency and the Federal Housing Administration on Friday extended their eviction moratoria through Sept. 30 for foreclosed borrowers and other occupants.

FHFA, FHA Extend Single-Family Eviction Moratoria through Sept. 30

The Federal Housing Finance Agency and the Federal Housing Administration on Friday extended their eviction moratoria through Sept. 30 for foreclosed borrowers and other occupants.