JLL, Wells Fargo and Eastdil Secured ranked as top commercial/multifamily mortgage originators last year, the Mortgage Bankers Association said today.

Tag: Fannie Mae

FHFA Authorizes Loan Processing Flexibilities for GSE Customers; Extends Comment Period on Proposed Minimum Financial Eligibility Requirements

The Federal Housing Finance Agency this week announced several loan processing flexibilities from Fannie Mae and Freddie Mac designed to help their customers.

JLL, Wells Fargo Lead MBA 2019 Commercial/Multifamily Mortgage Firm Origination Volume Rankings

JLL, Wells Fargo and Eastdil Secured ranked as top commercial/multifamily mortgage originators last year, the Mortgage Bankers Association said today.

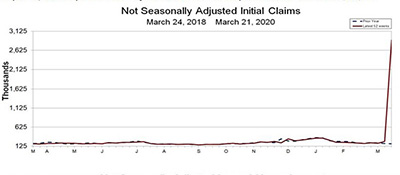

For 3.3 Million Americans, Coronavirus Economy Just Got Real

The Labor Department on Thursday said unemployment claims skyrocketed to 3.3 million—the first real indicator of just how potentially devastating the economic effects of the coronavirus can be at the personal and national levels.

FHFA: More Than 4.4 Million Homeowners Helped Since Conservatorship

The Federal Housing Finance Agency released its fourth quarter 2019 Foreclosure Prevention and Refinance Report, which shows Fannie Mae and Freddie Mac completed 25,930 foreclosure prevention actions, bringing to 4.407 million the number of troubled homeowners who have been helped during conservatorships.

FHFA Authorizes GSEs to Support Additional Liquidity in Secondary Mortgage Market; Provide Flexibility in Appraisals, Employment Verifications

The Federal Housing Finance Agency yesterday issued two directives to Fannie Mae and Freddie Mac—one to enter into additional dollar roll transactions to provide mortgage-backed securities investors with short-term financing of their positions; and the other to provide alternative flexibilities to satisfy appraisal requirements and employment verification requirements.

FHFA Authorizes GSEs to Support Additional Liquidity in Secondary Mortgage Market; Provide Flexibility in Appraisals, Employment Verifications

The Federal Housing Finance Agency this morning issued two directives to Fannie Mae and Freddie Mac—one to enter into additional dollar roll transactions to provide mortgage-backed securities investors with short-term financing of their positions; and the other to provide alternative flexibilities to satisfy appraisal requirements and employment verification requirements.

Coronavirus Update: HUD, FHFA Suspend Foreclosures/Evictions; MBA, Trade Groups Urge ‘Comprehensive’ Response from Congress

The Mortgage Bankers Association joined more than 100 other industry trade groups in a March 18 letter to Senate and House leaders, urging Congress to take appropriate steps to provide a coordinated and comprehensive response to businesses dealing with fallout from the coronavirus pandemic.

Coronavirus Update: HUD, FHFA Suspend Foreclosures/Evictions; MBA, Trade Groups Urge ‘Comprehensive’ Response from Congress

The Mortgage Bankers Association joined more than 100 other industry trade groups in a March 18 letter to Senate and House leaders, urging Congress to take appropriate steps to provide a coordinated and comprehensive response to businesses dealing with fallout from the coronavirus pandemic.

Faith Schwartz, Christy Moss, CMB: What Happens When COVID-19 Starts Affecting Mortgage Payments?

COVID-19’s economic impacts are only beginning to be felt in the United States, and already it’s been a wild ride.