The Federal Housing Finance Agency yesterday said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.

Tag: Fannie Mae

Fannie Mae: Record U.S. Expansion Likely Undone by COVID-19

The longest economic expansion in U.S. history has likely come to an end amid the unprecedented impacts of COVID-19, according to the Fannie Mae Economic and Strategic Research Group.

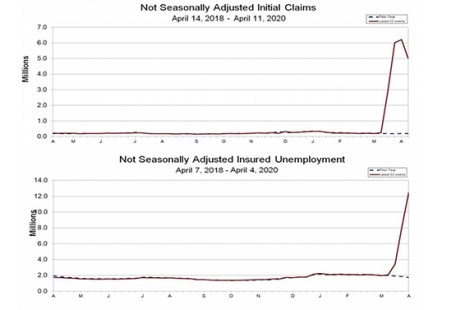

Another 5.2 Million Fill for Unemployment; 4-Week Total Rises to 22 Million

The Labor Department reported a seasonally adjusted 5.245 million people filed initial unemployment claims for the week of ending April 11, marking the fourth consecutive week of multi-million claims and bringing total claims filed in the past four weeks to more than 22 million.

FHFA, CFPB Announce Borrower Protection Program

The Federal Housing Finance Agency and the Consumer Financial Protection Bureau announced the Borrower Protection Program, a joint initiative that enables CFPB and FHFA to share servicing information to protect borrowers during the coronavirus national emergency.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

FHFA, CFPB Announce Borrower Protection Program

The Federal Housing Finance Agency and the Consumer Financial Protection Bureau announced the Borrower Protection Program, a joint initiative that enables CFPB and FHFA to share servicing information to protect borrowers during the coronavirus national emergency.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

Fannie Mae, Freddie Mac Extend URLA Implementation Timeline

Freddie Mac and Fannie Mae announced yesterday they will extend the implementation timeline for the redesigned Uniform Residential Loan Application and automated underwriting systems to support the industry during the COVID-19 pandemic.

Fannie Mae: COVID-19 Concerns Lead to Steep Drop in Housing Sentiment

Fannie Mae, Washington, D.C., said its monthly Home Purchase Sentiment Index fell by 11.7 points to 80.8 in March, its lowest reading since December 2016.

MBA Takes Issue with Calabria’s Downplay of Need for Servicer Liquidity Facility

The Mortgage Bankers Association called “troubling” comments by Federal Housing Finance Agency Director Mark Calabria in which he dismissed the immediate need for a federally backed liquidity facility to assist mortgage servicers with forbearance efforts resulting from the coronavirus pandemic.