The Federal Housing Finance Agency said it would extend some temporary loan origination flexibilities for Fannie Mae and Freddie Mac through May 31—and that’s it.

Tag: Fannie Mae

#MBASpring21: FHFA Director Calabria on Origination Flexibilities, Lessons Learned

A lot has happened in the past two years, Federal Housing Finance Agency Director Mark Calabria said yesterday at the Mortgage Bankers Association’s Spring Conference & Expo.

Industry Briefs Apr. 8, 2021

Top of Mind Networks, Atlanta, launched a bidirectional data connection between Surefire, its platform for automated mortgage marketing, and Salesforce, an enterprise CRM. The connection gives mortgage lenders choice and control over the way information is shared between their enterprise CRM and mortgage marketing technologies.

Housing Market Roundup: Apr. 6, 2021

Another round of housing market reports came across MBA NewsLink’s desk over the past few days. Here’s a summary of what’s happening:

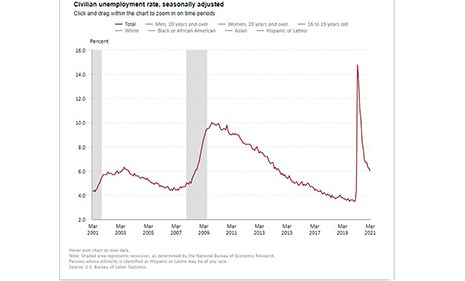

March Jobs Report: Full Steam Ahead

Another sign that the U.S. economy is heating up: the Bureau of Labor Statistics on Friday reported total nonfarm payroll employment rose by 916,000 in March, while the unemployment rate fell to 6 percent.

New Home Sales Take a February Hit

Historically, February has never been a big month for home sales—it’s cold, the weather is unpredictable and it’s, well, February. But during the hottest—and strangest—housing winter in memory, could this February also defy logic.

Industry Briefs Mar. 19, 2021

Fairway Independent Mortgage Corp., Madison, Wis., in the wake of recent actions by United Wholesale Mortgage to obtain exclusive partnerships with mortgage brokers, said it reaffirmed its commitment to all its mortgage origination partners, including mortgage brokers help consumers find options for financing a home.

Multifamily Market Musings: Q&A with MBA’s Sharon Walker

MBA NewsLink interviewed MBA Associate Vice President of Commercial/Multifamily Sharon Walker, who represents MBA members active in multifamily finance. She advocates on policy issues primarily related to Fannie Mae, Freddie Mac and the Federal Housing Administration and oversees numerous related committees, working groups, councils and events.

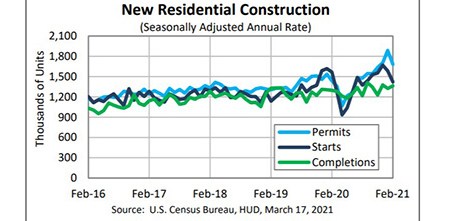

Winter Catches Up with February Housing Starts

Housing starts fell in February for the second straight month, HUD and the Census Bureau reported yesterday, with winter weather largely the culprit.

Sen. Toomey Issues Housing Finance Reform Principles

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.