The Mortgage Bankers Association last week sent a letter to Sen. Charles Grassley, R-Iowa, in support of his amendment to a bill that would make changes to enforcement of the False Claims Act.

Tag: False Claims Act

MBA, Trade Groups Oppose Amendment Altering False Claims Act

As the Senate plods toward what appears to be eventual passage of a massive infrastructure framework, the Mortgage Bankers Association and several other industry trade groups expressed opposition to an amendment that would unfavorably alter the False Claims Act.

#MBAIMB20: Housing Finance Reform—What It Means for Independent Mortgage Banks

NEW ORLEANS—After years of debate, housing finance reform is no longer a far-off concept. And government housing agencies appear poised to be part of the transition.

To the Point with Bob: Reducing False Claims Act Risk in FHA Lending

In the latest entry of his blog series, To the Point with Bob, Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, discusses HUD’s efforts to improve the FHA loan review process, as well as MBA’s advocacy to support those efforts.

To the Point with Bob: Reducing False Claims Act Risk in FHA Lending

In the latest entry of his blog series, To the Point with Bob, Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, discusses HUD’s efforts to improve the FHA loan review process, as well as MBA’s advocacy to support those efforts.

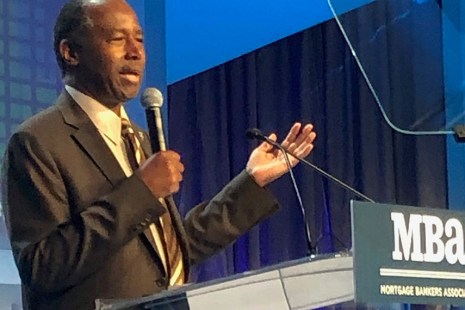

MBA Advocacy Update

Last Friday, MBA President and CEO Bob Broeksmit, CMB, attended a White House meeting chaired by HUD Secretary Ben Carson and attended by other senior administration officials and key industry stakeholders to discuss housing affordability. And on Monday, the Federal Housing Finance Agency announced it is seeking comment on pooling practices for Fannie Mae and Freddie Mac in the Uniform Mortgage-Backed Securities market.

HUD, Justice Department Reach Agreement on False Claims Act Violations

AUSTIN, TEXAS–HUD and the Department of Justice today signed a memorandum of understanding outlining “prudent” guidance for False Claims Act violations, a move that analysts said could help eliminate uncertainty in FHA lending and provide incentives for private market lending in government lending programs.