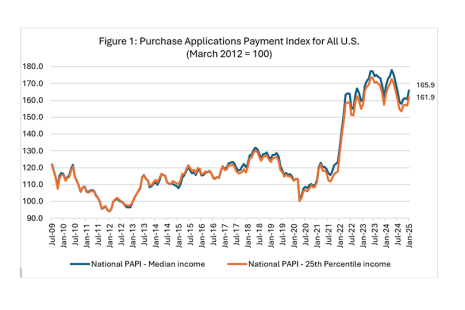

Homebuyer affordability declined slightly in April, with the national median payment applied for by purchase applicants increasing to $2,186 from $2,173 in March.

Tag: Edward Seiler

MBA: Mortgage Application Payments Decreased 1.4% to $2,173 in March

Homebuyer affordability improved in March, with the national median payment applied for by purchase applicants decreasing to $2,173 from $2,205 in February.

MBA: Mortgage Application Payments Remain Flat in February

Homebuyer affordability remained flat in February with the national median payment applied for by purchase applicants remaining unchanged at $2,205 in February.

MBA: Mortgage Application Payments Increased 3.7% to $2,205 in January

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,205 from $2,127 in December.

MBA: Mortgage Application Payments Flat in December

Homebuyer affordability improved slightly in December, with the national median payment applied for by purchase applicants decreasing to $2,127 from $2,133 in November, according to MBA’s Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time relative to income using data from MBA’s Weekly Applications Survey.

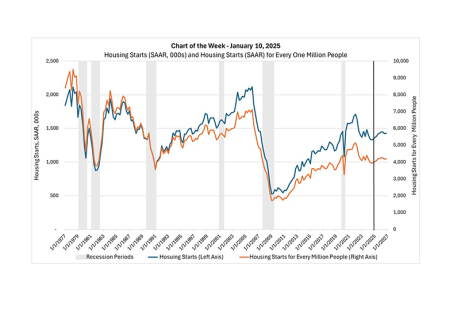

Chart of the Week: Housing Starts and Housing Starts for Every 1 Million People

In this week’s MBA Chart of the Week, we look at one statistic–aggregate single-family and multifamily housing starts–and examine how it has evolved since the start of the Carter Administration.

An Appreciation of Housing Policy Expert John C. Weicher

Former Assistant Secretary for Housing and Federal Housing Commissioner John C. Weicher passed away Dec. 10, 2024.

MBA: Mortgage Application Payments Increased 0.3% to $2,133 in November

Homebuyer affordability declined in November, with the national median payment applied for by purchase applicants increasing to $2,133 from $2,127 from October.

Most Older Americans Want to Age in Place, AARP Survey Finds

AARP, Washington, D.C., released its Home & Community Preferences national survey, finding that 75% of Americans 50-plus would like to stay in their current home for as long as possible.

MBA: Mortgage Application Payments Increase 4.2% to $2,127 in October

Homebuyer affordability declined in October, with the national median payment applied for by purchase applicants increasing to $2,127 from $2,041 in September, according to MBA’s Purchase Applications Payment Index.