Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,070 from $2,025 in December.

Tag: Edward Seiler

MBA: Mortgage Application Payments Decreased in December

Homebuyer affordability improved slightly in December, with the national median payment applied for by purchase applicants decreasing to $2,025 from $2,034 in November.

Chart of the Week: Homeownership Rates by Age, Race and Ethnicity

In this week’s MBA Chart of the Week, we examine the homeownership rate by household age as well as by race and ethnicity.

MBA: Mortgage Application Payments Decreased in November

Homebuyer affordability improved slightly in November, with the national median payment applied for by purchase applicants decreasing to $2,034 from $2,039 in October.

MBA: Mortgage Application Payments Decreased in October

Homebuyer affordability improved in October, with the national median payment applied for by purchase applicants decreasing to $2,039 from $2,067 in September, according to the Mortgage Bankers Association’s Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey.

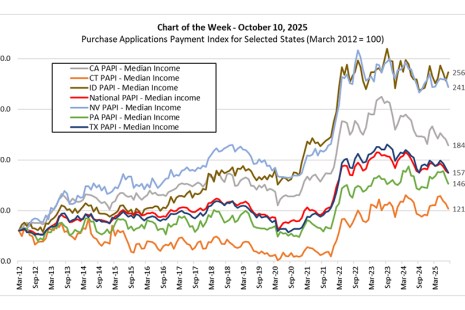

Chart of the Week: Purchase Applications Payment Index for Selected States

In this week’s Chart of the Week, we show the PAPI series – constructed using median Weekly Applications Survey (WAS) payments and median income – for the nation and six selected states.

Mortgage Application Payments Decrease in August

Homebuyer affordability improved in August, with the national median payment applied for by purchase applicants decreasing to $2,100 from $2,127 in August, according to MBA’s Purchase Applications Payment Index.

Chart of the Week: FOMC Summary of Economic Projections for Fed Funds Rate

Each quarter, the Federal Open Market Committee submit their projections for various economic measures. This month’s projections, shown in the Summary of Economic Projections, include 2028 for the first time.

Mortgage Application Payments Decreased in July, MBA Reports

Homebuyer affordability improved in July, with the national median payment applied for by purchase applicants decreasing to $2,127 from $2,172 in June.

MBA: Mortgage Application Payments Decreased in June

Homebuyer affordability improved in June, with the national median payment applied for by purchase applicants decreasing to $2,172 from $2,211 in May, according to MBA’s Purchase Applications Payment Index.