Down Payment Assistance is a growing part of the lender’s purchase business arsenal, so we interviewed Rob Chrane, founder and CEO of Down Payment Resource, to discuss the evolution of this market.

Tag: Down Payment Resource

MBA NewsLink Q&A: Rob Chrane, Founder and CEO, Down Payment Resource

Down Payment Assistance is a growing part of the lender’s purchase business arsenal, so we interviewed Rob Chrane, founder and CEO of Down Payment Resource, to discuss the evolution of this market.

DPR: 29 Homebuyer Assistance Programs Added in Q3

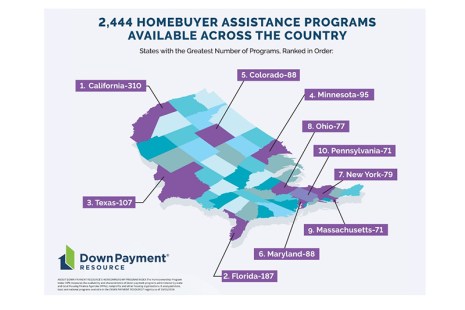

Down Payment Resource, Atlanta, released its Q3 Homeownership Program Index Report, highlighting the homebuyer assistance programs added and available in the quarter. The number offered reached 2,444 in Q3.

Manufactured Housing, Down Payment Assistance Expanding Affordable Housing Opportunities: Stacey Epperson and Rob Chrane

Manufactured housing may not have attracted your interest or investment in the past but with America’s worsening affordability crisis and recent regulatory updates at the federal level, this may be the time to rethink your strategy.

Manufactured Housing, Down Payment Assistance Expanding Affordable Housing Opportunities: Rob Chrane & Stacey Epperson

Manufactured housing may not have attracted your interest or investment in the past but with America’s worsening affordability crisis and recent regulatory updates at the federal level, this may be the time to rethink your strategy.

People in the News, Aug. 13, 2024

Industry personnel news from Mortgage Cadence, MISMO and Down Payment Resource.

Stacey Epperson and Rob Chrane: Manufactured Housing, Down Payment Assistance Expanding Affordable Housing Opportunities

Manufactured housing may not have attracted your interest or investment in the past but with America’s worsening affordability crisis and recent regulatory updates at the federal level, this may be the time to rethink your strategy.

Rob Chrane & Stacey Epperson: Manufactured Housing, Down Payment Assistance Expanding Affordable Housing Opportunities

Manufactured housing may not have attracted your interest or investment in the past but with America’s worsening affordability crisis and recent regulatory updates at the federal level, this may be the time to rethink your strategy.

Down Payment Resource: Homebuyer Assistance Programs Increase to Highest Count on Record

Down Payment Resource, Atlanta, released its Q2 Homeownership Program Index report, finding that the number of national homebuyer assistance programs has reached the highest count on record–2,415.

Rob Chrane & Chris Mock: Improving Affordability Despite an Uncertain Mortgage Environment

While financial institutions face the challenge of increasing originations and balancing the risk associated with loan affordability, a data-driven approach can help lenders expand the pool of potential borrowers.