Intercontinental Exchange Inc., Atlanta, provided its first look at October mortgage performance, finding that the delinquency rate hit 3.45% in October, up 6% from October 2023.

Tag: Delinquencies

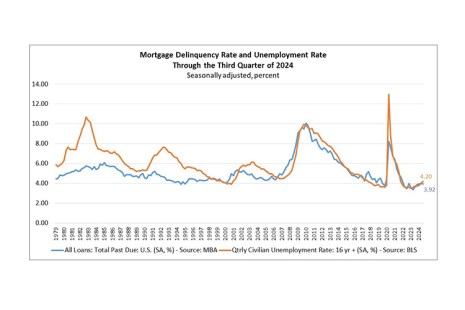

MBA: Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92% of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s National Delinquency Survey.

American Households With Record High Debt, Motley Fool Ascent Finds

American households are carrying an average of $104,215 in debt as of Q2 2024, amounting to $17.796 trillion total, Motley Fool Ascent, Alexandria, Va., found.

MBA: Commercial Mortgage Delinquency Rates Increased in First Quarter

Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

CoreLogic: Delinquency, Foreclosure Rates Low in February

CoreLogic, Irvine, Calif., reported the overall mortgage delinquency rate was at 2.8% in February, down from 3% in February 2023.

ICE First Look: Delinquencies Improve in February

Intercontinental Exchange Inc., Atlanta, released its first look at February mortgage performance, noting that the national delinquency rate was at 3.34%, down 4 basis points from the month before and 11 basis points lower than February 2023.

ICE: Delinquencies Tick Up in September, but Foreclosures Down

Intercontinental Exchange, Atlanta, released its “first look” at September 2023 month-end mortgage performance data, finding the national delinquency rate rose to 3.29%.

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.