TransUnion, Chicago, released a new analysis finding a correlation between rising payment-to-income ratios and rising mortgage delinquencies.

Tag: Delinquencies

ICE: Delinquencies Trend Slightly Higher in June

ICE Mortgage Technology’s First Look report found that delinquencies rose on a monthly basis and foreclosures were up year-over-year, despite overall mortgage payment performance remaining strong.

ICE First Look: Delinquencies Steady in May but Trending Higher Annually

ICE Mortgage Technology, Atlanta, released its May 2025 First Look, finding that the national delinquency rate fell 2 basis points to 3.2% in May. However, it’s up 16 basis points from May 2024.

VantageScore: Credit Scores Recover Overall, but Mortgage Delinquencies Grow

VantageScore, San Francisco, released its CreditGauge for March, finding that the average VantageScore 4.0 credit score returned to 702 after dipping slightly in February.

VantageScore CreditGauge: Mortgage Credit Delinquencies Rise in February

VantageScore, San Francisco, released its CreditGauge for February, finding mortgage credit delinquencies worsened year-over-year.

ICE First Look: Delinquencies Creep Up in February

Intercontinental Exchange Inc., released its “first look” at February mortgage performance, finding the national delinquency rate edged up five basis points to 3.53% in February.

VantageScore CreditGauge: Mortgages Help Drive Credit Balance Increases in January

VantageScore, San Francisco, released its CreditGauge report for January, finding average overall credit account balances rose by more than $1,000 from December 2024.

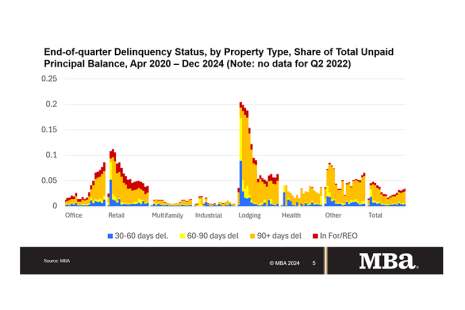

MBA: Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2024

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2024, according to the Mortgage Bankers Association’s latest commercial real estate finance (CREF) Loan Performance Survey.

TransUnion Predicts Mortgage Delinquencies Will Be Flat

TransUnion, Chicago, released its forecast for 2025, predicting that mortgage delinquencies will be flat a year from now in Q4 2025.

VantageScore: Overall Credit Balances Up in October, Driven by Mortgages

VantageScore, San Francisco, released its October CreditGauge, finding overall balances hit a new metric record for the fourth straight month.