The pandemic is evolving rapidly, requiring businesses to respond quickly. By this point, most lenders have confirmed employee well-being and transitioned workers to remote environments where possible. For their next move, lenders need to start playing an aggressive game of “what if.”

Tag: Coronavirus

Matt Hansen: New-Era ‘What-if’ Scenarios

The pandemic is evolving rapidly, requiring businesses to respond quickly. By this point, most lenders have confirmed employee well-being and transitioned workers to remote environments where possible. For their next move, lenders need to start playing an aggressive game of “what if.”

FHFA Authorizes GSEs to Support Additional Liquidity in Secondary Mortgage Market; Provide Flexibility in Appraisals, Employment Verifications

The Federal Housing Finance Agency yesterday issued two directives to Fannie Mae and Freddie Mac—one to enter into additional dollar roll transactions to provide mortgage-backed securities investors with short-term financing of their positions; and the other to provide alternative flexibilities to satisfy appraisal requirements and employment verification requirements.

Fed Bolsters Efforts to Stem Economic Impact of Coronavirus

The Federal Reserve, in its most aggressive actions to date, announced further steps yesterday to mitigate the economic impact of the coronavirus pandemic, including actions strongly advocated for over the weekend by the Mortgage Bankers Association.

FHFA Authorizes GSEs to Support Additional Liquidity in Secondary Mortgage Market; Provide Flexibility in Appraisals, Employment Verifications

The Federal Housing Finance Agency this morning issued two directives to Fannie Mae and Freddie Mac—one to enter into additional dollar roll transactions to provide mortgage-backed securities investors with short-term financing of their positions; and the other to provide alternative flexibilities to satisfy appraisal requirements and employment verification requirements.

Fed Revs Up Efforts to Stem Economic Effects of Coronavirus

The Federal Reserve, in its most aggressive actions yet, announced further steps this morning to mitigate the economic impact of the coronavirus pandemic, including actions strongly advocated for over the weekend by the Mortgage Bankers Association.

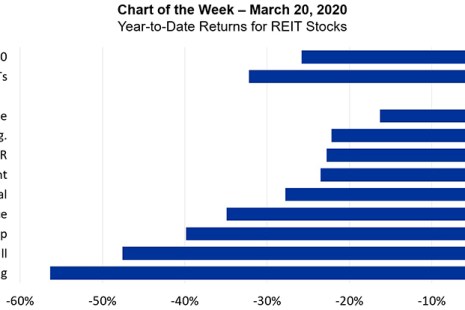

MBA Chart of the Week: Year-to-Date Returns for REIT Stocks

How the health, social and economic impacts of the coronavirus outbreak flow through to commercial and multifamily properties remains clouded in uncertainty – mainly because of the uncertainty about the virus itself and our public and private responses to it. One thing that is clear is that different property types and different markets will be affected differently.

MBA Urges Feds to Take Immediate Further Steps on Market Stabilization, Liquidity

The Mortgage Bankers Association on Sunday asked the Treasury Department and the Federal Reserve to take immediate further actions ensure orderly functioning of the housing finance market in response to the “extreme volatility” in financial markets arising from the spread of the coronavirus.

Federal Agencies ‘Will not Criticize’ Coronavirus Loan Mods

Six federal agencies on Sunday issued a joint statement encouraging financial institutions to “work constructively” with borrowers affected by the coronavirus pandemic and said they “will not criticize” loan modifications made in a “safe and sound” manner.

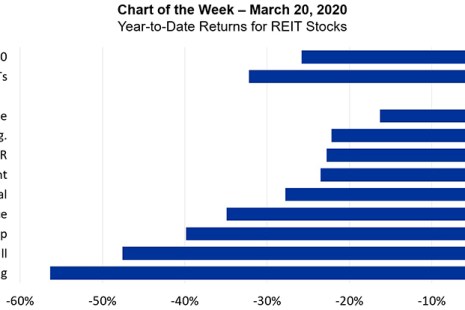

MBA Chart of the Week: Year-to-Date Returns for REIT Stocks

How the health, social and economic impacts of the coronavirus outbreak flow through to commercial and multifamily properties remains clouded in uncertainty – mainly because of the uncertainty about the virus itself and our public and private responses to it. One thing that is clear is that different property types and different markets will be affected differently.