The latest Fannie Mae Mortgage Lender Sentiment Survey found mortgage lenders’ profit margin outlook for the next three months fell slightly but remained positive due to strong reported refinance demand.

Tag: Coronavirus

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.

FCRA and the CARES Act: Putting in Right Procedures Now, Reducing Volume of Litigation Later

Over the past 10 years, Fair Credit Reporting Act lawsuits have almost quadrupled from some 1,350 cases in 2010 to 5,000 in 2019. FCRA allows plaintiffs to recover attorney fees, which may explain the increase.

Mark P. Dangelo: The Demise of the Contact Banker

Banking was a “contact” industry—prior to the Great Recession. With the loss of 12,000 branches in the past decade and consumers now doing over 90% of their transactions digitally, public health implications and social unrest, if sustained, may be the catalysts for closing many more branches by 2022.

ATTOM: Home-Flipping Reaches 14-Year High in 1Q; Returns Fall to 9-Year Low

ATTOM Data Solutions, Irvine, Calif., said its first-quarter U.S. Home Flipping Report showed 53,705 single-family homes and condominiums in the United States flipped in the first quarter, the highest number since 2006.

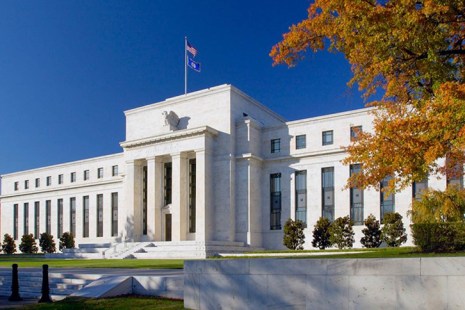

Fed: No Rate Hike Until ‘at Least 2022’

The Federal Open Market Committee yesterday offered cautious hope for an economic turnaround following the body-slam brought on by the coronavirus pandemic. But it soberly noted the economic recovery could take some time.

Zillow: Newly Unemployed Service Workers Owe $1.7 Billion/Month in Housing Payments

Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

MBA, Trade Groups Urge HUD to Modify FHA Forbearance Indemnification Policy

Sixteen industry trade organizations joined the Mortgage Bankers Association in a letter this week to HUD, expressing concerns with a recently announced FHA policy requiring lenders to provide 20 percent indemnification of the original loan amount for up to two years in relation to borrowers who enter into forbearance due to COVID19-related hardship after closing and prior to FHA insuring their loan.

Mortgage Applications Bounce Back in MBA Weekly Survey

Mortgage applications increased from one week earlier as key interest rates held steady, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 5.

Mark P. Dangelo: The Demise of the Contact Banker

Banking was a “contact” industry—prior to the Great Recession. With the loss of 12,000 branches in the past decade and consumers now doing over 90% of their transactions digitally, public health implications and social unrest, if sustained, may be the catalysts for closing many more branches by 2022.