Qualia, San Francisco, said a new survey reports a shift in perception on the permanence of remote work and a nearly 40% surge in remote online notarization usage from April to May.

Tag: Coronavirus

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell last week even as key interest rates held at record lows, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending June 19.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau yesterday issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell last week even as key interest rates held at record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 19.

May New Home Sales Post Healthy 16.6% Gain

Home buyer enthusiasm for new homes intensified in May, HUD and the Census Bureau reported yesterday, jumping by 16.6 percent from April and by nearly 13 percent from a year ago.

FHA Issues Temporary Waiver Suspending Early Payment Default Reviews

The Federal Housing Administration on Monday issued a temporary waiver of its Single-Family Housing Policy Handbook 4000.1 to temporarily suspend the requirement that mortgagees select and review all Early Payment Defaults on a monthly basis.

Lori Brewer: The Road to Recovery Will be Paved with Data

In a time when everything spells uncertainty, data gives lenders something to hold on to — and a path forward. What performance metrics are most critical for lenders to keep an eye on right now to help their businesses survive the recession and what’s likely to be a protracted recovery?

FHA Issues Temporary Waiver Suspending Early Payment Default Reviews

The Federal Housing Administration yesterday issued a temporary waiver of its Single Family Housing Policy Handbook4000.1 to temporarily suspend the requirement that mortgagees select and review all Early Payment Defaults on a monthly basis.

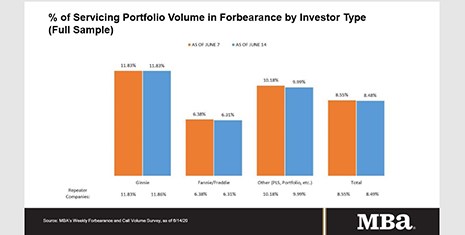

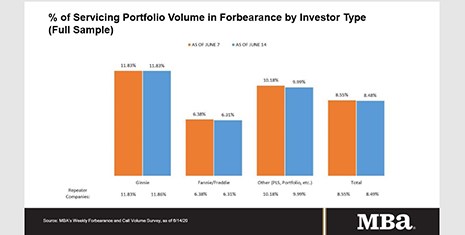

MBA: Shares of Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.