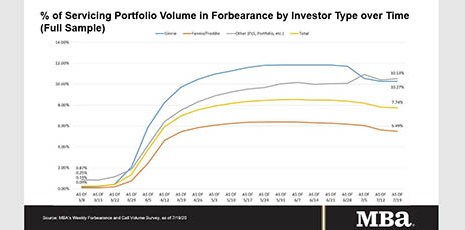

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Tag: Coronavirus

MBA Seeks Collaboration with CSBS on Remote Work Flexibility for State Licensees

The Mortgage Bankers Association asked the Conference of State Bank Supervisors to collaborate in addressing the real estate finance industry’s near-term issues related to work-from-home orders, and to build a longer-term framework for remote work capabilities to address future health emergencies, natural disasters and changing attitudes toward telework in today’s economy.

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

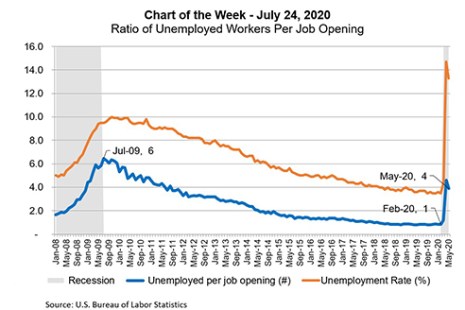

MBA Chart of the Week: Ratio of Unemployed Workers Per Job Opening

This week’s MBA Chart of the Week uses data from the U.S. Bureau of Labor Statistics to look at the ratio of the number of unemployed workers to job openings to highlight how the current recession is different than the recession in 2007-2009.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.

Steven Octaviano: Today’s Innovation Opportunity–And Why Lenders Must Embrace It

The technologies behind these changes have been with us for some time, but it took a crisis of mammoth proportions to accelerate adoption. Yet there are other areas of the mortgage business still sorely in need of innovation. And if lenders hope to remain competitive and thrive when the smoke from the pandemic clears, they need to be embracing these innovations today.

Home Sellers’ Asking Prices Up 13% from Last Year as Demand Keeps Soaring

Redfin, Seattle, said listing prices of homes for sale nationally jumped by 13% to a record-high $328,500 during the four-week period ending July 12.

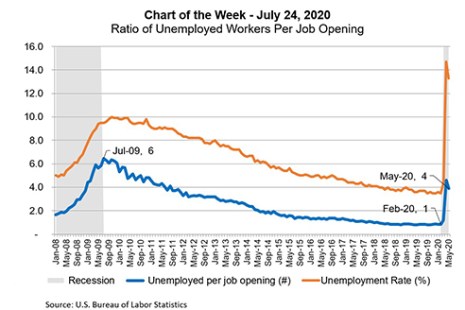

MBA Chart of the Week: Ratio of Unemployed Workers Per Job Opening

This week’s MBA Chart of the Week uses data from the U.S. Bureau of Labor Statistics to look at the ratio of the number of unemployed workers to job openings to highlight how the current recession is different than the recession in 2007-2009.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.

Kelly Hamill and Andrew Foster: Seniors Housing Spotlight

All property types have felt some effects from COVID-19, but seniors housing is a special case. It has seen a variety of impacts including in occupancy rates and expenses.