As COVID-19 continues to affect the mortgage industry, lenders are realizing that conducting business as usual may not be possible or plausible. For a lender’s growth to reach new and different heights in 2020, new and different business practices, such as working with a hedge advisory firm, are required.

Tag: Coronavirus

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell for the first time in four weeks, albeit slightly, as the 30-year fixed rate held at a record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 24.

The CMBS Market During the Pandemic: A Conversation with Moody’s Investors Service

MBA NewsLink interviewed Keith Banhazl, Victor Calanog and Nick Levidy from Moody’s, New York.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell for the first time in four weeks, albeit slightly, as the 30-year fixed rate held at a record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 24.

July Consumer Confidence Dips Amid Coronavirus Resurgence

The Conference Board, New York, said its Consumer Confidence Index fell for the third time in four months in July, amid growing concerns over the resurgence of COVID-19 nationwide.

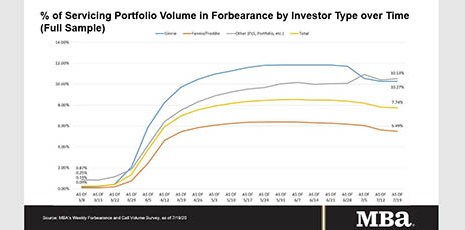

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

The CMBS Market During the Pandemic: A Conversation with Moody’s Investors Service

MBA NewsLink interviewed Keith Banhazl, Victor Calanog and Nick Levidy from Moody’s, New York.

MBA Seeks Collaboration with CSBS on Remote Work Flexibility for State Licensees

The Mortgage Bankers Association asked the Conference of State Bank Supervisors to collaborate in addressing the real estate finance industry’s near-term issues related to work-from-home orders, and to build a longer-term framework for remote work capabilities to address future health emergencies, natural disasters and changing attitudes toward telework in today’s economy.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.