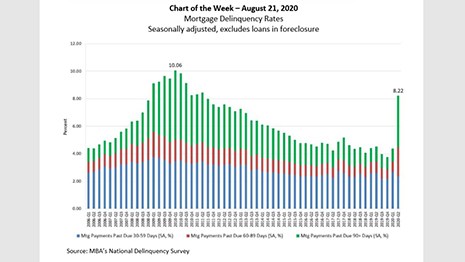

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

Tag: Coronavirus

Sponsored Content from Pavaso: Data Privacy and Working with eClosing Service Providers (Aug. 24, 2020)

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Insurance Quotes and Coverages: A Conversation with CWCapital’s George O’Neil III and Harbor Group’s Emily Rasmussen

MBA CREF Associate Director Kelly Hamill interviewed Emily Rasmussen, Managing Director of Business Strategy with Harbor Group Consulting, and George O’Neil III, Managing Director with CW Financial Services LLC, about the insurance market during the coronavirus pandemic.

Radian: U.S. Home Prices Continue to Rise Amid Housing Imbalances

Radian, Philadelphia, said after a strong finish to the first half of 2020, home prices across the United States continued to rise sharply, albeit at a slower pace in July from June.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.

Mortgage Applications Drop in Latest MBA Weekly Survey

Mortgage interest rates jumped back over 3 percent last week, resulting in a decrease in mortgage refinance applications, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 14.

Andrew Foster: CMBS Market Musings

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.

Home Buyers Not Rushing Back to Open Houses

The trend toward virtual real estate—a necessity during this coronavirus pandemic—might become permanent, with potential home buyers continuing to show little enthusiasm for open houses, said Redfin, Seattle.

Mortgage Applications Drop in Latest MBA Weekly Survey

Mortgage interest rates jumped back over 3 percent last week, resulting in a decrease in mortgage refinance applications, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 14.

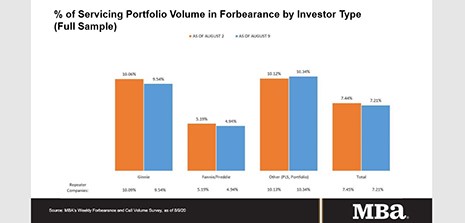

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.