Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

Tag: Coronavirus

Brian Zitin: Foreshadowing Future Appraisal Bottlenecks During Covid-19

Lenders are seeing record-breaking volume month over month, and it doesn’t seem to be slowing down. One thing that has slowed down across the industry, however, is appraisal turn times. As the volume of loans requiring appraisals goes up, the number of appraisers seems to be going in the opposite direction.

Despite Record-Low Rates, Mortgage Applications Dip in MBA Weekly Survey

Despite the lowest 30-year fixed rates in the history of the Mortgage Bankers Association’s Weekly Applications Survey, mortgage applicants appeared to step back for the week ending Oct. 9.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

Despite Record-Low Rates, Mortgage Applications Dip in MBA Weekly Survey

Despite the lowest 30-year fixed rates in the history of the Mortgage Bankers Association’s Weekly Applications Survey, mortgage applicants appeared to step back for the week ending Oct. 9.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

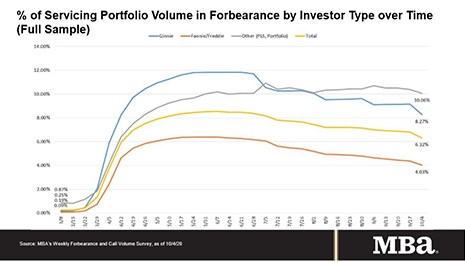

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

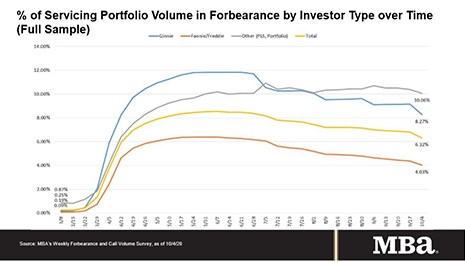

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

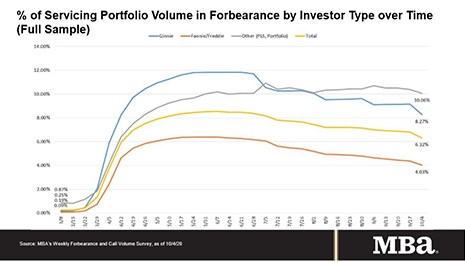

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.