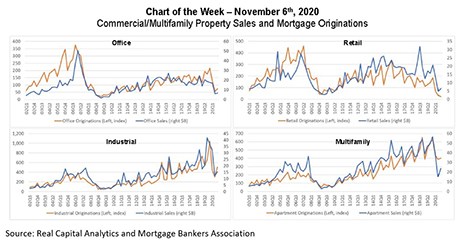

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

Tag: Coronavirus

Trevor Gauthier of ACES Quality Management on Early Payment Defaults

Trevor Gauthier is CEO of ACES Quality Management, formerly known as ACES Risk Management (ARMCO). He has more than 20 years of executive experience in leading growth initiatives for tech organizations and building teams both organically and through acquisition.

Jennifer Henry: Reducing Risk and Increasing Efficiency for Digital Mortgages with Third-Party Verifications

The digitization process has accelerated as mortgage professionals seek ways to efficiently meet the high demand for both purchase and refinance applications.

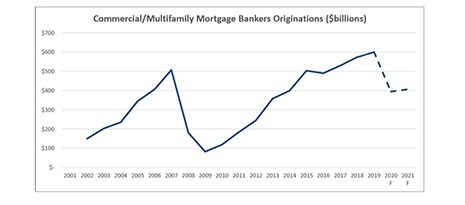

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent for the week ending October 30, 2020 compared to one week earlier, the Mortgage Bankers Association reported this morning.

Rob Wiggins: 20 Years of Mortgage–A Look Back

The past 20 years in the mortgage industry have been full of change, innovation and most importantly, lessons to be learned. Even in just the past few months, mortgage lenders have had to completely transform their business processes in the wake of the COVID-19 crisis. As the industry continues to prepare for what’s next, it’s important to take a look back at how far the industry has actually come.

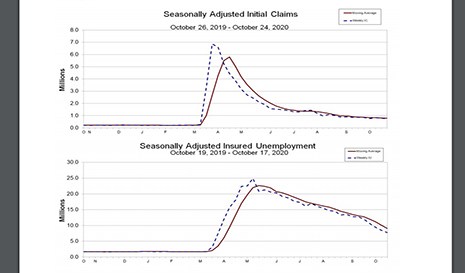

Initial Claims Fall to Lowest Level Since March

Initial claims for unemployment insurance fell to their lowest level since March, the Labor Department reported yesterday, but remain elevated from pre-pandemic levels.

Rob Wiggins: 20 Years of Mortgage–A Look Back

The past 20 years in the mortgage industry have been full of change, innovation and most importantly, lessons to be learned. Even in just the past few months, mortgage lenders have had to completely transform their business processes in the wake of the COVID-19 crisis. As the industry continues to prepare for what’s next, it’s important to take a look back at how far the industry has actually come.

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

Paul Anselmo of Evolve Mortgage Services: A Primer on SMART Docs

Paul Anselmo is CEO and founder of Evolve Mortgage Services and SigniaDocuments Inc, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries.