Mortgage applications fell slightly even as key interest rates remained below 3 percent, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 13.

Tag: Coronavirus

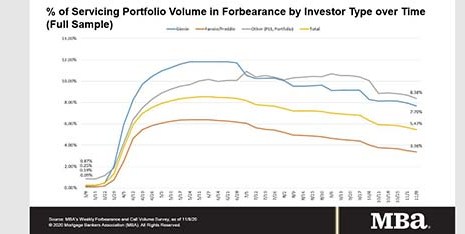

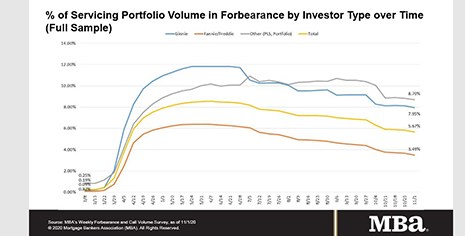

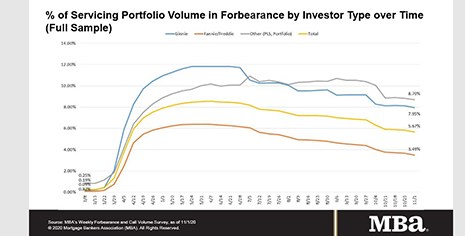

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

Mortgage Applications Mixed Despite Record-Low Rates

Despite record-low mortgage rates, mortgage applications fell by 0.5 percent from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 6.

Mortgage Applications Mixed Despite Record-Low Rates

Despite record-low mortgage rates, mortgage applications fell by 0.5 percent from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 6.

‘Not Ok? That’s Ok:’ Financial Services, Consumer Coalition Launches Borrower Awareness Campaign

The Mortgage Bankers Association and a broad coalition of financial services stakeholders – including mortgage servicers, trade associations, housing counseling agencies, governmental agencies and think tanks – launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

6 Months into COVID, More Than Half of Americans Have Difficulty Paying Down Debt

More than half of respondents to a survey conducted by BAI, Chicago, and the National Foundation for Credit Counseling said the coronavirus pandemic has affected their personal finances, making it difficult to pay some debts.

Broeksmit: ‘MBA Was Made for Times of Crisis’

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.