The Mortgage Bankers Association and a broad coalition of financial services stakeholders recently launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

Tag: Coronavirus

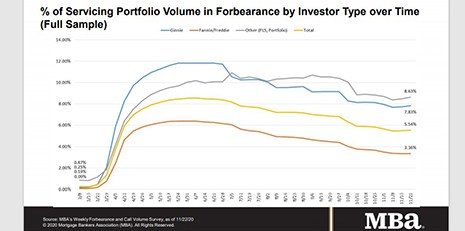

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

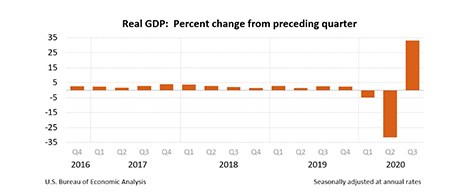

Revised 3Q GDP Unchanged at 33.1%

Meet the new gross domestic product—same as the old gross domestic product. The Bureau of Economic Analysis on Wednesday reported its second (revised) estimate of third quarter GDP was unchanged from its first estimate last month: in other words, after an unbelievably bad second quarter, the third quarter looks, in contrast, relatively brilliant.

Debarchana Roy: Touchless Covid-Tech to Support Customer Well-Being, Customer Engagement

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.

Mortgage Applications Increase on Record-Low Interest Rates in MBA Weekly Survey

With mortgage rates falling record lows for the 14th time this year, borrowers took the bait, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 20.

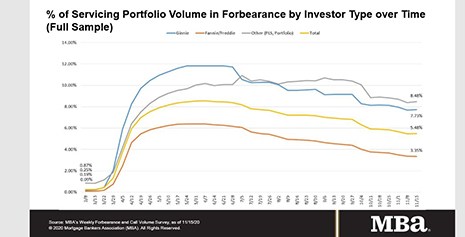

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

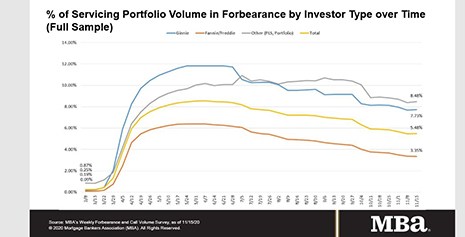

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

Debarchana Roy: Touchless Covid-Tech to Support Customer Well-Being, Customer Engagement

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.

Debarchana Roy: Touchless Covid-Tech to Support Customer Wellbeing, Customer Engagement

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications fell slightly even as key interest rates remained below 3 percent, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending November 13.