With mortgage interest rates falling yet again to record lows, homeowners took advantage to refinance; purchase buyers, not so much, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 4.

Tag: Coronavirus

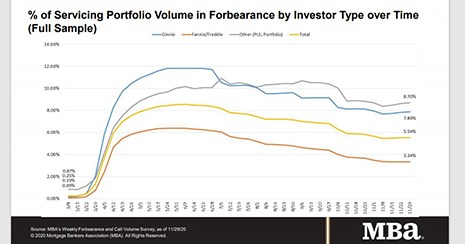

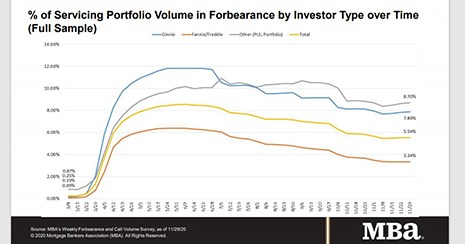

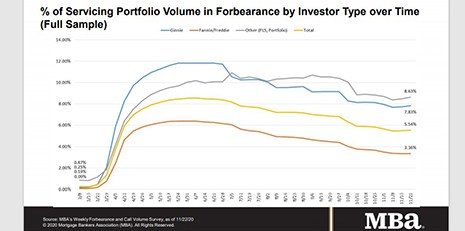

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

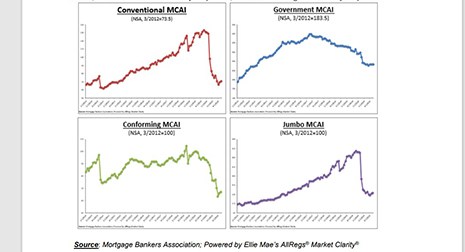

Mortgage Credit Availability at 4-Month High

Mortgage credit availability increased in November to its highest level since July, the Mortgage Bankers Association reported this morning.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

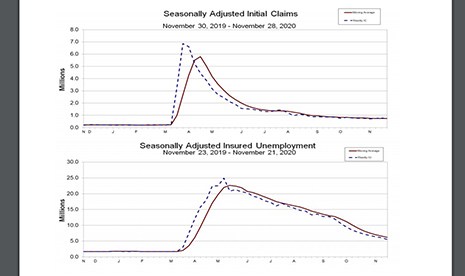

Jobless Claims Drop, Remain Elevated

Initial claims fell in the week ending Nov. 28, the Labor Department reported yesterday, but remain elevated in the wake of the coronavirus pandemic and resulting economic slowdown.

Mortgage Applications Dip Slightly in MBA Weekly Survey

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

Mortgage Applications Dip Slightly in MBA Weekly Survey

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

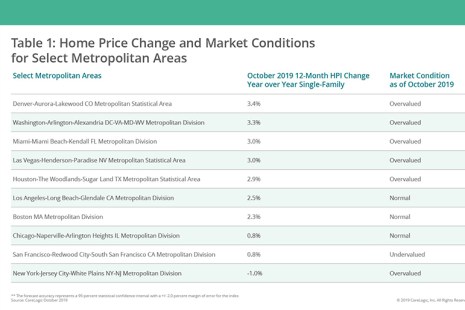

‘Gaining Momentum’: October Annual U.S. Home Prices Up 7.3%

CoreLogic, Irvine, Calif., said home prices increased by 7.3% in October from a year ago, marking the fastest annual appreciation since April 2014.