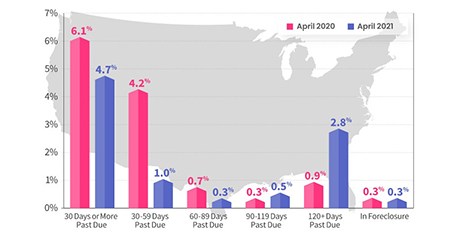

CoreLogic, Irvine, Calif., said all stages of mortgage delinquency except for the serious delinquency rate improved on an annual basis for the first time since March 2020.

Tag: CoreLogic

Dealmaker: Regent Properties Acquires San Diego Office Portfolio for $420M

Regent Properties, Los Angeles, acquired four high-rise San Diego office buildings for $420 million.

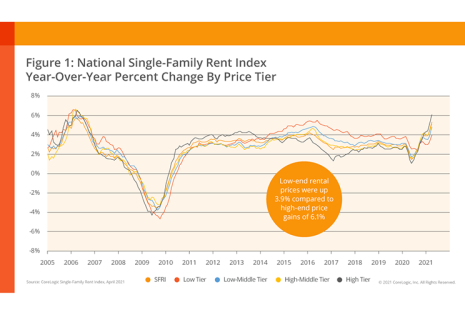

Single-Family Rent Growth Exceeds Pre-Pandemic Rates

Rent growth in single-family rental properties now exceeds pre-pandemic rates across all price tiers, including low-end rentals for the first time, reported CoreLogic, Irvine, Calif.

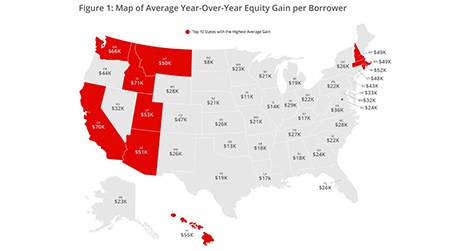

1Q Homeowner Equity Gains $1.9 Trillion

Corelogic, Irvine, Calif., said “underwater” (negative equity) homes decreased by 24% year over year in the first quarter, while the average homeowner gained $33,400 in equity year over year.

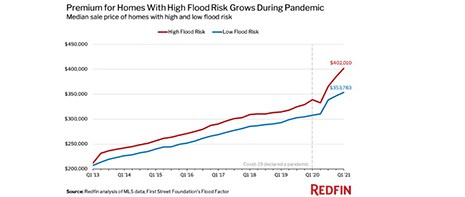

Despite Risk, Homes in High-Flood Areas Flying Off the (Continental) Shelves

Hurricane seasons and climate change are threatening to redraw coastal U.S. maps. But it’s not stopping homebuyers from chasing down waterfront properties.

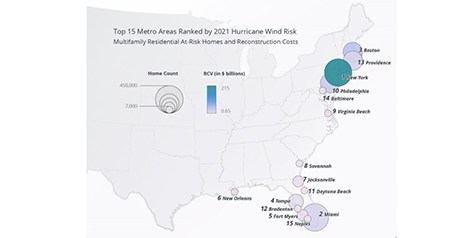

As Hurricane Season Starts, 31 Million Homes ID’d as ‘High-Risk’

Yesterday (June 1) marked the start of the 2021 hurricane season. The National Oceanic and Atmospheric Administration projected another “above-normal” season, with as many as 20 named storms, 6-10 hurricanes and 3-5 major hurricanes (Category 3 or higher).

CoreLogic: Home Prices Rise at Fastest Pace Since 2006

CoreLogic, Irvine, Calif., said sparse inventory and high demand placed upward pressure on home prices, leading to a third straight month of double-digit percentage growth.

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.