Paul Fiorilla is Director of Research at Yardi Matrix. His research covers all facets of commercial real estate and he recently published a report highlighting different environmental risk levels across metro areas in the U.S. MBA Newslink interviewed him about the implications of recent environmental, social and governance trends.

Tag: Commercial Real Estate

ESG and its Impacts on CRE

Environmental, Social and Governance criteria is an investment strategy focused on making the world a better place. This is not a new idea; versions of sustainable investing trends have emerged in the past. But the explosive growth and rapidly increasing capital allocation toward “ESG” friendly assets is unprecedented.

ESG and its Impacts on CRE

Environmental, Social and Governance criteria is an investment strategy focused on making the world a better place. This is not a new idea; versions of sustainable investing trends have emerged in the past. But the explosive growth and rapidly increasing capital allocation toward “ESG” friendly assets is unprecedented.

ESG and its Impacts on CRE

Environmental, Social and Governance criteria is an investment strategy focused on making the world a better place. This is not a new idea; versions of sustainable investing trends have emerged in the past. But the explosive growth and rapidly increasing capital allocation toward “ESG” friendly assets is unprecedented.

ESG and its Impacts on CRE

Environmental, Social and Governance criteria is an investment strategy focused on making the world a better place. This is not a new idea; versions of sustainable investing trends have emerged in the past. But the explosive growth and rapidly increasing capital allocation toward “ESG” friendly assets is unprecedented.

A Record Year for Adaptive Reuse

More than 20,000 units in older office and other commercial buildings will be converted to apartments this year, reported RentCafe, Santa Barbara, Calif.

Many Markets See Commercial Real Estate Values Return to Pre-Pandemic Levels

Commercial real estate values have returned to pre-pandemic levels in many U.S. markets, continuing a recovery that began at year-end 2020, said CBRE, Dallas.

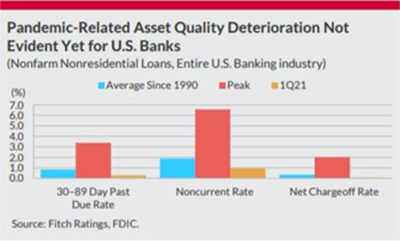

Fitch Ratings: Small U.S. Banks Most Exposed to Commercial Real Estate Losses

Fitch Ratings, Chicago, said the U.S. commercial real estate market will likely see deteriorating credit metrics once stimulus measures wind down and forbearance programs expire, with smaller CRE-concentrated banks more susceptible to elevated losses, which are expected to peak below levels seen in the past.

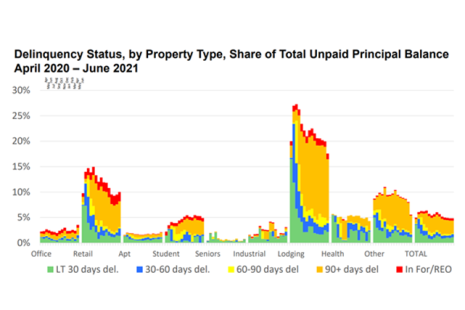

June Commercial, Multifamily Mortgage Delinquencies Hold Steady

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey said.

Grant Carlson: The Supreme Court Ruling on CDC Residential Eviction Moratorium

On Tuesday the U.S. Supreme Court in, a 5-4 ruling, declined to lift the national Center for Disease Control and Prevention’s residential eviction moratorium. The ruling responds to a request to lift the D.C. Federal District Court’s stay, which has effectively paused its order invalidating the CDC moratorium. Presumably, the CDC eviction moratorium will expire on July 31.