MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Tag: Commercial Real Estate

North American CRE Market Reacts to COVID Downturn

After a strong start to 2020, COVID-19’s impacts on North American commercial real estate hit during the second quarter, reported Transwestern, Houston, and Devencore, Toronto.

Keeping Current with TD Bank Commercial’s Gregg Gerken

MBA NewsLink interviewed Gregg Gerken, Head of Commercial Real Estate for TD Bank. He is responsible for a $20 billion investment real estate portfolio and a $2 Billion LIHTC Equity portfolio serving regional institutional real estate clients.

MBA, Affiliate Groups Submit Main Street Lending Program Recommendations

The Mortgage Bankers Association and affiliated groups shared recommendations with the Senate Banking Committee to improve the Main Street Lending Program’s effectiveness for commercial real estate owners and tenants.

Keeping Current With Midland Loan Services’ Tim Steward

MBA NewsLink interviewed Timothy E. Steward, Senior Vice President and co-head of Midland Loan Services, a PNC Real Estate business. Steward leads a team of more than 500 professionals responsible for delivering loan servicing, asset management and technology services to the commercial real estate finance industry.

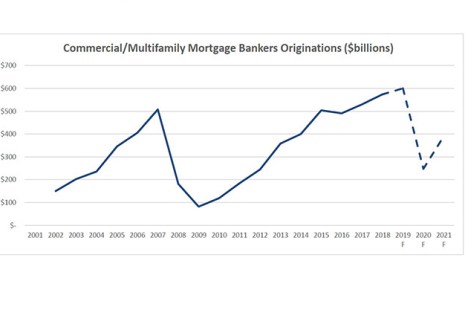

COVID-19 Pandemic to Cause Commercial/Multifamily Lending Pullback in 2020

Commercial and multifamily mortgage bankers are expected to close $248 billion in loans backed by income-producing properties this year, a 59 percent decline from 2019’s record volume of $601 billion, a new Mortgage Bankers Association forecast said.

Andrew Foster: Commercial Observer Power Finance List Stacked with MBA Leadership

The Commercial Observer’s annual listing of commercial real estate finance power players includes some names familiar to MBA members. The list identifies the 50 most powerful figures in commercial real estate finance.

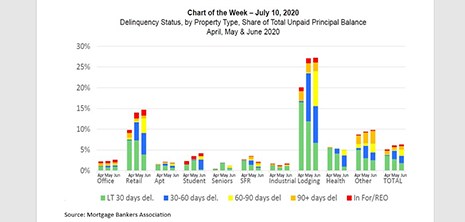

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

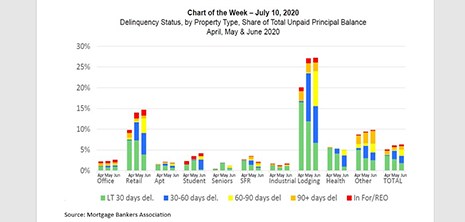

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

This week in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.