As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.

Tag: Commercial Real Estate

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Top 10 Ways to Engage with MBA CREF

It’s that time of year again. The annual renewal invoices for your trade association memberships arrive. You think about how you leveraged memberships over the past year but it’s likely that your company could have done more to get the most out of it. Here are a few suggestions on how commercial/multifamily members can effectively leverage Mortgage Bankers Association resources to get the most benefit from your firm’s membership.

Top 10 Ways to Engage with MBA CREF

It’s that time of year again. The annual renewal invoices for your trade association memberships arrive. You think about how you leveraged memberships over the past year but it’s likely that your company could have done more to get the most out of it. Here are a few suggestions on how commercial/multifamily members can effectively leverage Mortgage Bankers Association resources to get the most benefit from your firm’s membership.

Insurance Quotes and Coverages: A Conversation with CWCapital’s George O’Neil III and Harbor Group’s Emily Rasmussen

MBA CREF Associate Director Kelly Hamill interviewed Emily Rasmussen, Managing Director of Business Strategy with Harbor Group Consulting, and George O’Neil III, Managing Director with CW Financial Services LLC, about the insurance market during the coronavirus pandemic.

Insurance Quotes and Coverages: A Conversation with CWCapital’s George O’Neil III and Harbor Group’s Emily Rasmussen

MBA CREF Associate Director Kelly Hamill interviewed Emily Rasmussen, Managing Director of Business Strategy with Harbor Group Consulting, and George O’Neil III, Managing Director with CW Financial Services LLC, about the insurance market during the coronavirus pandemic.

Insurance Quotes and Coverages: A Conversation with CWCapital’s George O’Neil III and Harbor Group’s Emily Rasmussen

MBA CREF Associate Director Kelly Hamill interviewed Emily Rasmussen, Managing Director of Business Strategy with Harbor Group Consulting, and George O’Neil III, Managing Director with CW Financial Services LLC, about the insurance market during the coronavirus pandemic.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

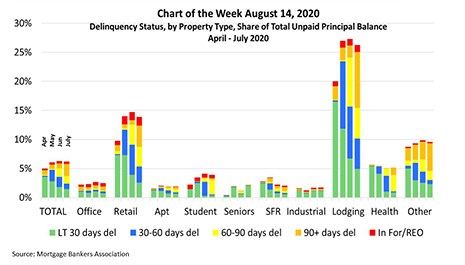

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.