Investors are preparing to deploy more capital into the commercial real estate market in 2026, supported by stabilizing pricing expectations, improved fundamentals and optimism about declining debt costs, according to CBRE, Dallas.

Tag: Commercial Real Estate

Colliers Sees CRE Momentum

Colliers, Seattle, said the commercial real estate market enters 2026 with “renewed momentum” as stabilizing fundamentals, easing financial conditions, strengthening occupier demand and rising investor confidence set the stage for a long-awaited reset.

PREA Forecast: Modest Commercial Real Estate Recovery Next Year

The commercial real estate market could see a “modest” recovery next year, with total returns forecasted at 5.9% in 2026, according to the Pension Real Estate Association, Hartford, Conn.

Fitch: CRE Refinancing Stability Underpinned by Resilient Debt Capital Markets

U.S. commercial real estate loan refinancing remains “resilient,” with ample liquidity absorbing this year’s elevated maturities, according to Fitch Ratings, Chicago/Toronto.

LightBox: CRE Activity Index Pauses as Investors Await Fed Signal

Commercial real estate activity slipped in August, according to LightBox, Irvine, Calif. The firm’s CRE Activity Index dipped to 104.8 from July’s 111.8.

SitusAMC Finds CRE Market Remains Attractive Despite Interest Rate Challenges

SitusAMC, Houston, found signs that commercial real estate currents are beginning to shift despite stubbornly high interest rates and rapidly changing economic policies.

LightBox: CRE Index Posts Strongest Reading Since 2022, but Outlook Uncertain

LightBox, New York, reported its Commercial Real Estate Activity Index rose sharply in March to 104.4, the highest level since June 2022 and only the second triple-digit reading in nearly three years.

LightBox Says CRE Activity Surged in February Despite Federal Policy Shifts

LightBox, Irvine, Calif. reported a sharp rise in its February commercial real estate activity Index, which climbed to 96.1, up from 80.7 in January and 75.8 a year ago.

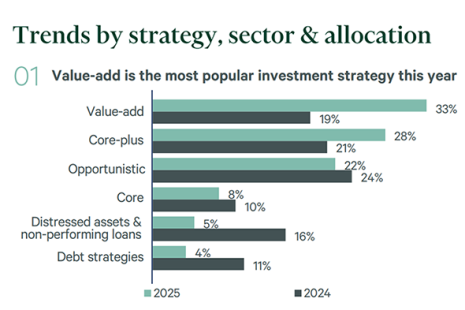

Investors Poised to Deploy More Capital in 2025: CBRE

CBRE, Dallas, said investors are gearing up to inject more capital into the U.S. commercial real estate market this year, driven by favorable pricing and despite the challenges posed by interest rate fluctuations.

MSCI: Insurance Taking Bigger Bite from Commercial Property Income

Higher insurance premiums are increasing commercial real estate operating costs and cutting into net operating income, according to MSCI, New York.