MBA NewsLink interviewed Mortgage Bankers Association Associate Vice President of Housing Finance Policy Dan Fichtler and Associate Vice President of Commercial/Multifamily Andrew Foster about the transition away from the London Interbank Offered Rate to a successor index for floating-rate loans.

Tag: Commercial/Multifamily

MBA Names Michael Flood SVP of Commercial/Multifamily Policy and Member Engagement

The Mortgage Bankers Association appointed Michael P. Flood as Senior Vice President of Commercial/Multifamily Policy and Member Engagement.

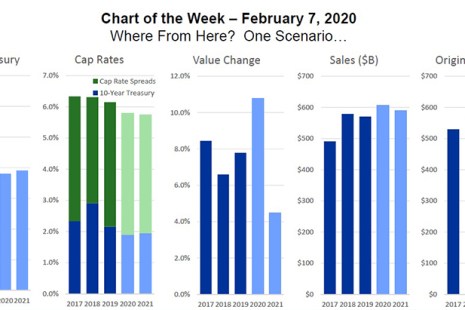

MBA Chart of the Week: Where from Here? One Scenario

On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

CREF Outlook Survey: Majority of Firms Expect Originations to Increase in 2020

Following an anticipated record year of lending in 2019, commercial and multifamily mortgage originators expect 2020 to be another strong year in activity, according to the Mortgage Bankers Association’s 2020 Commercial Real Estate Finance Outlook Survey.

New MBA White Paper Analyzes Commercial Real Estate Market Trends, Outlook

The Mortgage Bankers Association this morning released a new white paper, Where From Here?, which examines current economic trends and commercial/multifamily real estate market conditions and summarizes recent comprehensive data–by property type and capital source–reported by MBA’s research team.

MBA White Paper Illustrates CMBS Market’s ‘Significant Role’ in Commercial/Multifamily Real Estate Finance

The Mortgage Bankers Association this morning released a white paper, Role of CMBS in the Financing of Commercial and Multifamily Real Estate in America, which provides an overview of the commercial mortgage-backed securities market and highlights the vital role it plays as a capital source for the financing of commercial real estate.

Preparing Your Institution’s Commercial Lending Landscape for 2020

In just two short months, we will be heading into a new year and a new decade. To prepare, many institutions are planning their budget and objectives for the next year to ensure growth and profitability. With the start of a new decade, institutions are looking for ways to better equip their team with offerings and technology to meet the needs of current and future borrowers and evolve the lending process.

Preparing Your Institution’s Commercial Lending Landscape for 2020

In just two short months, we will be heading into a new year and a new decade. To prepare, many institutions are planning their budget and objectives for the next year to ensure growth and profitability. With the start of a new decade, institutions are looking for ways to better equip their team with offerings and technology to meet the needs of current and future borrowers and evolve the lending process.

Commercial Servicing Software Must be Flexible

Commercial servicing software needs to be flexible and scalable. It must accommodate a variety of loan products; include commercial-specific reporting, payment and escrow administration functionality; and provide support for asset managers.

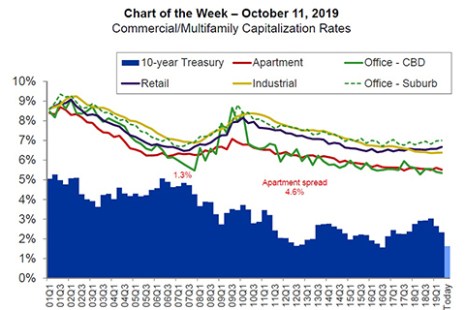

MBA Chart of the Week: Commercial/Multifamily Capitalization Rates

Commercial real estate values are dictated by property incomes and capitalization rates, or the yields investors are looking to receive on their investments.