MBA Chart of the Week: Commercial/Multifamily Capitalization Rates

Source: Real Capital Analytics; Federal Reserve Board.

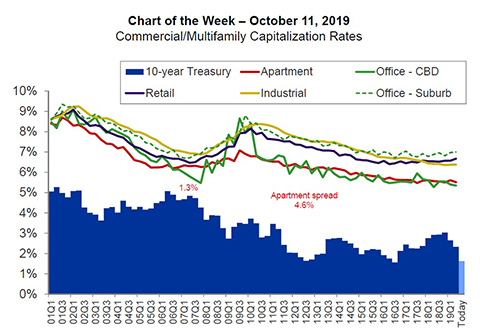

Commercial real estate values are dictated by property incomes and capitalization rates, or the yields investors are looking to receive on their investments. In past cycles, as investors have turned bullish on commercial real estate, the spread between U.S. Treasuries and cap rates has tended to shrink, falling to just 130 basis points for apartments during the 2007 market boom.

When investors have turned bullish in the past, the spread tends to rise–hitting 460 basis points for apartment properties during the Global Financial Crisis more than a decade ago. Cap rates therefore capture both overall investment market yields and how commercial real estate is viewed relative to those other markets.

In recent quarters, investors have expected yields on Treasuries and other investments to rise in the future, putting upward pressure on cap rates, and therefore downward pressure on property values. Instead, the 10-year Treasury is now yielding just above 1.6 percent, and many investors expect yields may stay “lower-for-longer.”

How will cap rates and property values react? If investors see increased risk for commercial real estate relative to Treasuries, then the spread between cap rates and Treasuries might be expected to hold at its now elevated level (roughly 390 basis points for apartment properties)–perhaps keeping cap rates and property values flat, despite lower base rates.

If, on the other hand, investors continue to see U.S. commercial real estate as a relatively stable investment alternative amidst uncertainty in the global economy, then stable cap rate spreads would bring lower all-in cap rates, and a rise in property values. Given how low cap rates are, even a small change in terms of basis points could mean a significant change in value.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)