The summer has brought big news for the housing industry including but not limited to multifamily market participants.

Tag: Commercial/Multifamily

Andrew Foster: Multifamily Values Amid a Shifting Landscape

The summer has brought big news for the housing industry including but not limited to multifamily market participants.

MBA, Trade Groups Urge Fairness on ‘Carried Interest;’ Support for ‘INVEST in America’ Bill

The Mortgage Bankers Association and more than a dozen industry trade groups warned Congress that legislation and a separate Biden Administration proposal to change longstanding tax laws on “carried interest” could have damaging implications for Americans who use partnerships to develop, own and operate real estate.

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

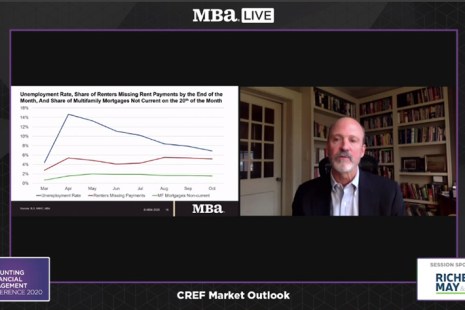

CREF Market Outlook: Commercial Real Estate’s Four-Bucket Theory

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

ULI Forecast Sees Potential Rebound in 2021-2022

The Urban Land Institute, Washington, D.C., said a consensus of real estate economists surveyed expect a short-lived recession and above-average GDP growth in 2021 and 2022.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

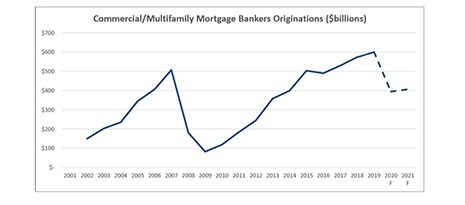

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.