Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.

Tag: CMBS

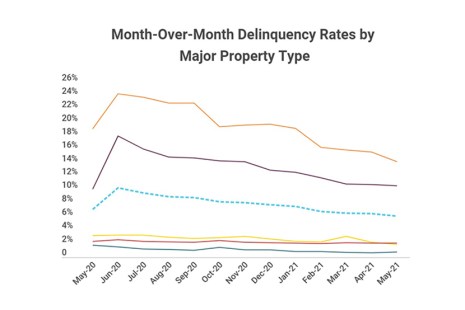

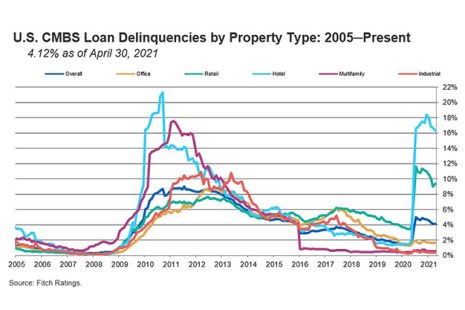

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

CMBS Delinquency Rate Improvement Reaches 11-Month Mark

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in May, posting its biggest drop in three months.

CMBS Delinquencies Tick Up; Special Servicing Rate Drops

The commercial mortgage-backed securities delinquency rate and special servicing rate moved in opposite directions in April, two new reports said.

CMBS Supply-Demand Fundamentals Dip

Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market dipped in fourth-quarter 2020.

CMBS Delinquency Rate Falls For Ninth Straight Month

The commercial mortgage-backed securities delinquency rate fell once again in March and most CMBS rating actions were affirmations, analysts reported.

KBRA: Review Those Remittance Reports

Kroll Bond Rating Agency, New York, said higher commercial mortgage-backed securities special servicing volume and modifications increase the risk of operational errors or inconsistencies in servicer and trustee reporting.

CMBS Delinquency Rate Drops 8th Straight Month

In February, the commercial mortgage-backed securities delinquency rate saw its largest improvement since the pandemic started last year, reported Trepp, New York.

CMBS Delinquency Rate Declines for Third Straight Month

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 14 basis points in January to 4.55 percent due to a slowing pace of new delinquencies and strong new issuance.