Independent mortgage banks and mortgage subsidiaries of chartered banks reported a simple average pre-tax net profit of 18 basis points, or $701 on each loan they originated in the third quarter, according to MBA’s Quarterly Mortgage Bankers Performance Report.

Tag: Chart of the Week

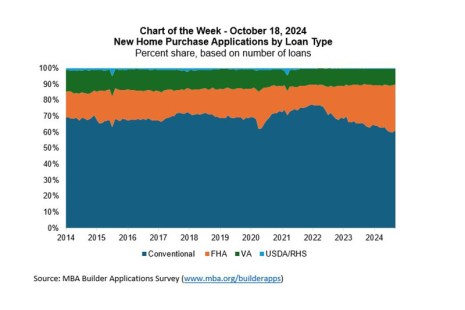

MBA Chart of the Week: New Home Purchase Applications by Loan Type

Mortgage applications to buy newly built homes have been seeing year-over-year growth since 2023, and in the MBA Builder Applications Survey results for September 2024, purchase applications were up 11% on an annual basis.

MBA Chart of the Week: Purchase Applications Index

In the wake of stronger economic data, including reports on jobs and inflation, mortgage rates have moved higher, with the 30-year fixed rate rising to 6.36%– the highest since August, based on the most recent data from the MBA’s Weekly Applications Survey.

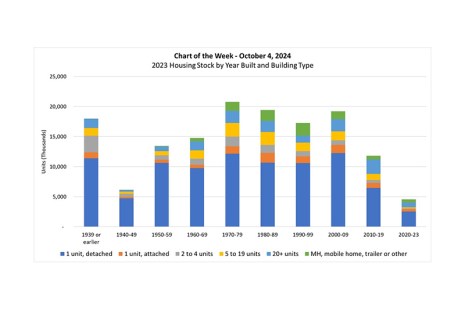

MBA Chart of the Week: 2023 Housing Stock by Year Built and Building Type

In this week’s MBA Chart of the Week, we show the stock of homes in the U.S. by the decade built and by building type.

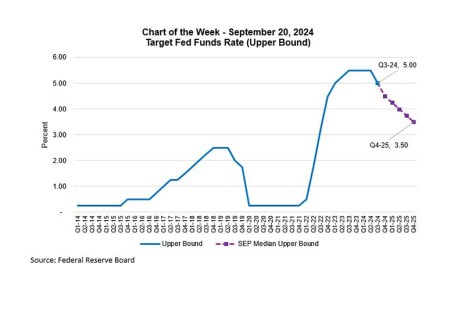

MBA Chart of the Week: Target Fed Funds Rate

The FOMC lowered the target Fed Funds rate by 50 basis points at its September meeting and signaled that this is the first cut in a series that is expected to bring the Fed Funds rate down by about 2 percentage points by the end of 2025.

MBA Chart of the Week: 2023 HMDA Respondents

A total of 4,874 companies reported lending activity under the Home Mortgage Disclosure Act (HMDA) in 2023, according to MBA’s analyses of the dataset.

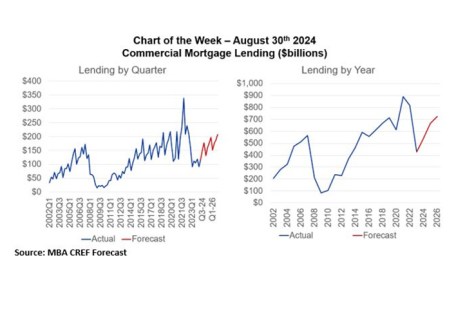

MBA Chart of the Week: Commercial Mortgage Lending

Is the logjam in CRE transaction activity starting to break?

MBA Chart of the Week: Pre-Tax Net Production Income and Production Volume

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of 17 basis points, or $693 on each loan they originated in the second quarter. according to MBA’s Quarterly Mortgage Bankers Performance Report.

MBA Chart of the Week: Early-Stage vs. Seriously Delinquent Mortgage Rates

According to the latest results from MBA’s National Delinquency Survey (NDS) released last week, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024.

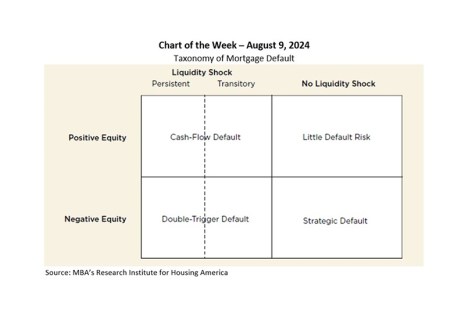

MBA Chart of the Week: Taxonomy of Mortgage Default

The Research Institute for Housing America recently released a special report that looked at the lessons learned from the Great Financial Crisis, the COVID-19 pandemic, and other past episodes of default, to understand how to design a more robust mortgage system that proactively supports sustainable homeownership.