As the July 31 federal eviction moratorium expiration approaches, the Biden administration, Consumer Financial Protection Bureau, the Mortgage Bankers Association and industry groups are working together to inform apartment owners and renters about the rental assistance programs available to them.

Tag: CFPB

Quote

“MBA appreciates and supports the Biden administration and CFPB awareness campaign to make sure tenants and landlords take advantage of the emergency rental assistance programs available to help cover rent, utilities and other housing costs. With the CDC nationwide eviction moratorium set to expire on July 31, we are working closely with our multifamily loan servicing members to communicate to their borrowers that billions of dollars is available to help tenants and landlords in need.”

–MBA President and CEO Bob Broeksmit, CMB.

Industry Briefs July 22, 2021

Covius, Denver, announced New American Funding implemented Covius Document Solutions for its default servicing operations. Specifically, New American will use Covius’ 50-state template library and on-demand printing services to prepare and deliver compliant pre-foreclosure/breach letters.

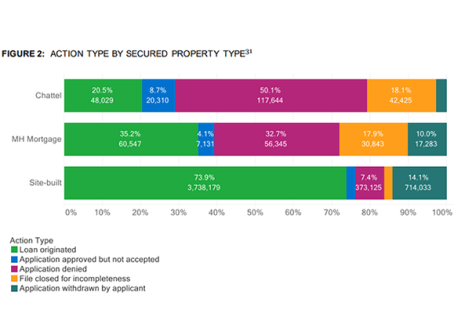

CFPB: Manufactured Housing Loan Borrowers Face Higher Interest Rates, Risks and Barriers to Credit

The Consumer Financial Protection Bureau said manufactured housing can be an affordable but potentially risky avenue for homeownership.

CFPB: Consumer Complaints Higher in Predominantly Minority Areas

The Consumer Financial Protection Bureau issued a bulletin this week analyzing complaints submitted by consumers in counties nationwide. The Bureau reported in 2019 and 2020, it received more complaints on a per-capita basis from consumers living in predominantly minority counties than from consumers in predominantly white, non-Hispanic counties.

#MBASpring21: FHFA Director Calabria on Origination Flexibilities, Lessons Learned

A lot has happened in the past two years, Federal Housing Finance Agency Director Mark Calabria said yesterday at the Mortgage Bankers Association’s Spring Conference & Expo.

Industry Briefs Nov. 3, 2020

News in brief from SimpleNexus, Black Knight, the Consumer Financial Protection Bureau and TovoData.

MBA Advocacy Update Sept. 14, 2020

With Congress (most notably the Senate) unable to reach consensus on the passage of any additional COVID-related economic relief, MBA sent a letter last Tuesday to the CFPB responding to the Bureau’s proposed rule revising the General QM definition. The letter explains MBA’s support for the price-based QM construct, and offers several recommendations to help ensure the rule meets its stated goals of robust consumer protections and broad access to sustainable credit.

MBA Responds to CFPB’s Proposed Rule Revising the General Qualified Mortgage Definition

On Tuesday, the Mortgage Bankers Association commented on the Consumer Financial Protection Bureau’s proposed rule to amend its General Qualified Mortgage (QM) loan definition in Regulation Z.

MBA Advocacy Update Aug. 10, 2020

As congressional leaders and the administration remain deadlocked in negotiations on the next potential COVID-19 relief package, MBA’s advocacy on key federal regulatory and state-based actions has continued.