MBA’s Bob Broeksmit issued a statement in response to the CFPB rescinding its 2024 regulation that would have established a public registry of nonbank entities subject to certain agency and court orders and withdrawing its 2023 proposal to create a registry of nonbank contract terms and conditions:

Tag: CFPB

Premier Member Editorial: The Compliance Gap Is Growing, and Servicers Can’t Afford to Fall In

During the pandemic, federal regulators led the charge on borrower protections. Now that they are stepping aside, servicers are navigating a fractured regulatory landscape with little federal guidance, Covius’ Jennifer Keys writes.

MBA Premier Member Editorial: A Diminished CFPB–How Will States Respond?

Asurity’s Jonas Hoerler and Diane Jenkins write that with the scaling back and refocusing of the CFPB, the financial services industry is left with uncertainty about what the future holds.

Bob Broeksmit on MBA Advocacy, Priorities in New Administration

“In this whirlwind of dramatic change–whether a slew of executive orders or landmark legislation coming down the road, MBA is not hanging back and waiting to see how this will play out,” MBA President and CEO Bob Broeksmit, CMB, said at MBA’s National Advocacy Conference.

MBA Sends Letter to Senate Banking Committee on CFPB Director Nominee Jonathan McKernan

The Mortgage Bankers Association sent a letter to Senate Banking Committee leadership to express the real estate finance industry’s strong support for the nomination of Jonathan McKernan to be the next Director of the Consumer Financial Protection Bureau.

MBA Statement on the Nomination of Jonathan McKernan as CFPB Director

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on Jonathan McKernan’s nomination to serve as Director of the Consumer Financial Protection Bureau (CFPB).

What’s Next in Washington? Industry Leaders Weigh In

DALLAS–“From HUD to CFPB to the chairs of key committees on Capitol Hill, MBA is bracing for big change,” said Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, in a session on post-election analysis at MBA’s 2025 Servicing Solutions Conference & Expo.

MBA Calls on CFPB to Delay Effective Dates of Registry of Nonbank Covered Persons

In light of President Trump’s “Regulatory Freeze Pending Review” executive order issued last week, the Mortgage Bankers Association asked the CFPB to postpone for 60 days the effective compliance dates for entities subject to its Nonbank Registration Regulation issued on June 3, 2024.

MBA and State MBAs, Consumer Advocates Welcome Long-Awaited Rule on PACE Loans

The Mortgage Bankers Association and National Consumer Law Center, along with the California Mortgage Bankers Association, Housing Policy Council, Jacksonville Area Legal Aid, Mortgage Bankers Association of Missouri, Mortgage Bankers Association of Florida, and Public Counsel of California issued the following joint statement in response to the Consumer Financial Protection Bureau’s final rule on consumer protections for residential Property Assessed Clean Energy (PACE) loans.

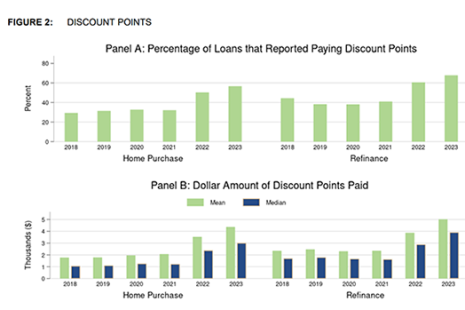

CFPB Reports Significant Drop in Mortgage Applications, Originations in 2023

The Consumer Financial Protection Bureau, Washington, D.C., found a significant decline in mortgage lending activities during 2023. Loan applications and originations dropped by nearly one-third from 2022.