U.S. life sciences employment has wavered between small gains and declines since 2022 as the sector grappled with capital constraints and layoffs, leaving its growth prospects fragile this year, according to a new report from CBRE.

Tag: CBRE

CBRE Reports Office Conversions, Demolitions Will Exceed New Construction in 2025–Aiding Office Market Recovery

More office space will be removed from the U.S. market this year than added to it for the first time since at least 2018, which indicates the market is stabilizing, according to CBRE, Dallas.

CBRE Forecasts Modest Hotel RevPAR Growth

CBRE, Dallas, forecasts that hotel revenue per available room will grow modestly this year, driven in part by the continued outperformance of urban locations.

CRE Lending Increases in Q1 Despite Market Volatility, CBRE Finds

Commercial real estate lending surged in the first quarter, driven by higher financing volumes and “robust” activity from banks, though caution persists due to government policy and economic uncertainty impacting Treasury yields, according to CBRE, Dallas.

CBRE: U.S. Multifamily Rebound Continues in Q1

CBRE, Dallas, found the overall multifamily vacancy rate fell to 4.8% in Q1, as renter demand continued to outpace new deliveries.

Office Building Owners Offering Fewer Concessions to Tenants, CBRE Finds

The enticements that companies receive to sign new office leases declined last year, on average, for the first time since at least 2019, according to CBRE, Dallas.

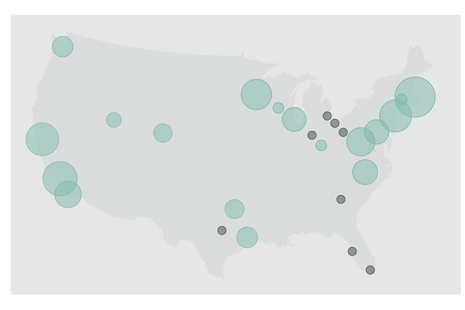

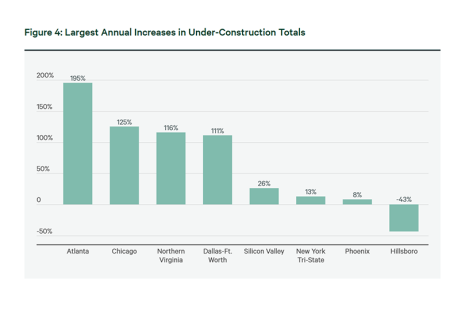

CBRE: Data Centers See Strong 2024

CBRE, Dallas, reported supply in primary data center markets increased by 34% year-over-year in 2024, significantly more than the 26% increase in 2023.

CBRE Forecasts Steady Hotel Sector Growth

CBRE, Dallas, forecasts that hotel revenue per available room will grow steadily in 2025 and urban locations will outperform due to improved travel and the recovery of inbound international travel.

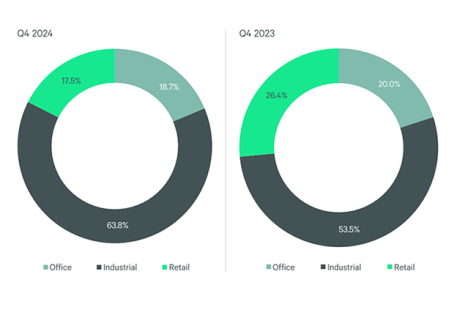

Net-Lease Investment Volume Surges, Driven by Strong Industrial Demand

U.S. net-lease investment surged last year, according to new research from CBRE.

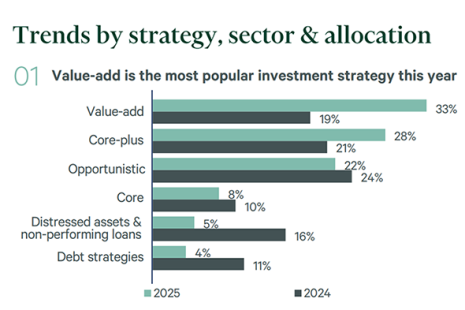

Investors Poised to Deploy More Capital in 2025: CBRE

CBRE, Dallas, said investors are gearing up to inject more capital into the U.S. commercial real estate market this year, driven by favorable pricing and despite the challenges posed by interest rate fluctuations.